Table of Contents

Home / Blog / Cryptocurrency

Who’s Offering The Best White Label Crypto Exchanges In The US

September 22, 2025

September 22, 2025

As demand for digital asset infrastructure surges, the white label crypto exchange market in the US is becoming indispensable for businesses aiming for rapid market entry. The US cryptocurrency exchange platform market generated approximately USD 11.95 billion in revenue in 2023, projected to soar to USD 70.76 billion by 2030, reflecting a robust CAGR of 28.9%.

Simultaneously, institutional engagement continues to climb—71% of institutional investors held or intend to hold spot cryptocurrencies as of mid-2025.

Choosing the right white label provider can significantly influence strategic access to liquidity, compliance, and technological agility. This article explores the leading companies offering the best white label crypto exchange platform providers in the USA.

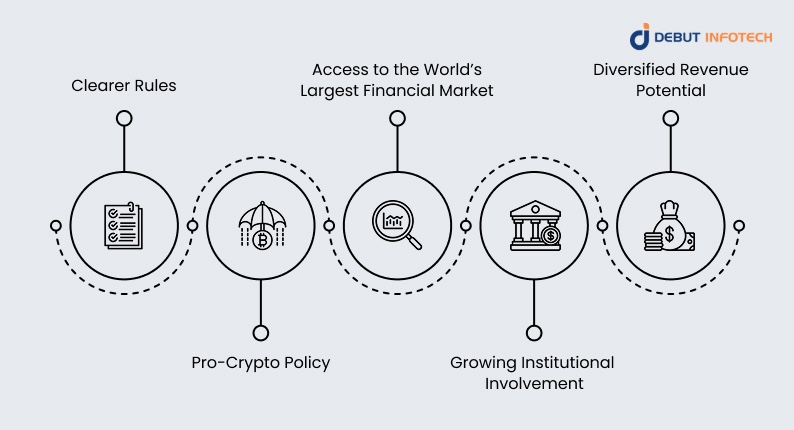

Why Launch Your Crypto Exchange in the US?

Launching a crypto exchange in the United States provides unmatched opportunities. From regulatory clarity to institutional adoption, the US offers conditions that support long-term growth and global market influence.

1. Clearer Rules

The US is steadily moving toward clearer cryptocurrency regulations, offering much-needed legal clarity for businesses. Agencies like the SEC, CFTC, and FinCEN are creating compliance guidelines that reduce ambiguity and set operational standards. This structured environment gives exchange operators confidence to innovate without fear of sudden regulatory shifts, fostering stability in long-term operations.

2. Pro-Crypto Policy

Although regulations continue to evolve, US lawmakers and regulators are increasingly signaling support for responsible crypto innovation. With initiatives promoting blockchain research and balanced oversight, the environment has grown more encouraging for entrepreneurs. This pro-innovation stance reassures businesses that they can expand while governments work to balance consumer protection with technological advancement.

3. Access to the World’s Largest Financial Market

The United States offers unmatched access to the world’s largest financial market, with deep pools of retail and institutional investors. For exchanges, this translates into unparalleled liquidity, robust trading activity, and opportunities for scaling. Launching locally also facilitates partnerships with major financial players, ensuring strong positioning within the global digital asset economy.

4. Growing Institutional Involvement

The growing participation of institutional investors in the US—ranging from investment banks to hedge funds—is reshaping the crypto landscape. Their entry increases liquidity, credibility, and mainstream adoption. Exchanges operating domestically can leverage these developments to attract institutional clients, establish trust, and secure long-term growth within a maturing and increasingly sophisticated financial ecosystem.

5. Diversified Revenue Potential

Operating in the US enables operators (i.e., top decentralized exchanges) to explore multiple revenue models beyond traditional trading fees. From staking and lending services to derivatives and custodial solutions, businesses can diversify offerings in response to market demands. This variety of income streams strengthens financial resilience while ensuring relevance in a competitive, innovation-driven global marketplace.

Top US White Label Crypto Exchange Builders for 2025

Choosing the right builder is just as important as selecting the right market. The following companies represent some of the strongest players offering white label crypto exchange solutions in the US for 2025.

1. Debut Infotech

Debut Infotech, founded in 2011 and headquartered in India, has expanded its services globally across the US, Europe, and Southeast Asia. Its portfolio includes crypto exchanges, fintech platforms, and blockchain-based applications for startups and enterprises alike. Notable clients span emerging fintech ventures to established digital asset firms.

Features: Offers white-label exchange platforms with multi-asset support, API integration, customizable UI/UX, and compliance-ready modules.

Focus: End-to-end p2p crypto exchange development with a strong emphasis on regulatory alignment and modular scalability.

Best for: Businesses seeking full-stack, compliant crypto exchange solutions with rapid deployment capabilities.

KeyPoints:

- Years of experience: 10+

- Number of employees: 100–150 (estimated)

- Projects completed: 100+

- Hourly rate: $25 – $49

- Ratings at Clutch: 4.9

- Reputed patrons: fintech startups and mid-tier crypto firms

2. OPENWARE

OPENWARE (formerly known as HollaEx’s corporate umbrella) is headquartered in Singapore, serving global clients across Asia, Europe, and North America. Its portfolio includes trading engines, exchange frameworks, and blockchain integration solutions.

Features: High-throughput trading engine, modular architecture, multi-blockchain support, advanced exchange technology, and developer tools.

Focus: Scalable, enterprise-ready exchange infrastructure and third-party blockchain integrations.

Best for: Large enterprises and exchanges requiring flexible, scalable, and tech-rich platforms.

KeyPoints:

- Years of experience: 8+ (aligned with HOLLAEX timeline)

- Number of employees: same 10–49 (as HollaEx/OPENWARE group)

- Projects completed: multiple

- Hourly rate: $100 – $149

- Ratings at Clutch: 4.5

- Reputed patrons: blockchain developers, white-label operators

3. LeewayHertz

Founded in 2007 and headquartered in San Francisco (with significant operations in Gurgaon, India), LeewayHertz has delivered over 100 enterprise-grade digital solutions—spanning blockchain, AI, IoT—for Fortune 500 firms and startups. Its client list includes ESPN, NASCAR, Hershey’s, McKinsey, P&G, Siemens, 3M, and Pearson.

Features: Custom blockchain exchange and wallet development, smart contracts, dApp infrastructure, ICO/NFT solutions, marketplace platforms, and token launch support.

Focus: Tailor-made, enterprise-level blockchain systems and digital asset platforms.

Best for: Organizations needing highly customized, long-term blockchain and exchange ecosystems.

KeyPoints:

- Years of experience: 18

- Number of employees: 101–250

- Projects completed: 100+ digital platforms

- Hourly rate: $50 – $99

- Ratings at Clutch: 4.7

- Reputed Patrons: ESPN, NASCAR, P&G, McKinsey, Siemens, and others

4. Rapid Innovation

Rapid Innovation is a US-based software development and consultancy firm known for agile delivery and fintech solutions. Founded in 2019, the firm likely serves startups and SMEs in emerging markets.

Features: Presumably offers modular white-label exchange frameworks with user-focused front ends, compliance add-ons, and rapid deployment.

Focus: Speeding time-to-market through flexible, scalable white-label models.

Best for: Startups requiring cost-effective and efficient entry into the crypto exchange market.

KeyPoints:

- Years of experience: 6

- Number of employees: 50 – 249

- Projects completed: 125+ products delivered

- Hourly rate: $100 – $149

- Ratings at Clutch: unspecified

- Reputed Patrons: unspecified

5. Alphapoint

Alphapoint was founded in 2013 and is headquartered in New York, USA, with additional offices in Europe and Asia. Its portfolio includes powering global exchanges, brokerages, and institutional trading platforms via its white-label infrastructure.

Features: Robust trading engine, liquidity aggregation, multi-asset support, co-location infrastructure, advanced risk management, and API-driven customization.

Focus: Institutional-grade exchange infrastructure for high-volume and regulated markets.

Best for: Financial institutions and large enterprises needing professional-grade scalability and performance.

KeyPoints:

- Years of experience: 12 years

- Number of employees: 50 –200 (estimated)

- Projects completed: Dozens of exchange implementations

- Hourly rate: not publicly disclosed

- Ratings at Clutch: not listed

- Reputed patrons: Global digital asset firms and traditional financial institutions

6. HashCash Consultants

Founded in 2015 and headquartered in Palo Alto, California, HashCash Consultants operates from India. It serves clients globally, including governments, financial institutions, and Fortune 500 firms. Its portfolio includes deploying white-label cryptocurrency exchanges, digital asset platforms, and blockchain infrastructure for enterprises worldwide.

Features: Their white-label exchange software includes KYC/AML compliance, multi-currency support, scalable SegWit-compatible infrastructure, secure wallets (both hot and cold), liquidity management, and customizable matching engines.

Focus: Delivering white-label crypto exchanges rapidly—some claims suggest launches in as few as five days—while prioritizing scalability and security.

Best for: Enterprises, financial institutions, or governments seeking quick-to-deploy, feature-rich, and compliance-oriented solutions.

KeyPoints:

- Years of experience: 9–10 (since 2015)

- Number of employees: 100–249

- Projects completed: 20+

- Hourly rate: $50 – $99

- Ratings at Clutch: 5.0

- Reputed Patrons: Governments, financial institutions, and large enterprises globally

Factors to Consider When Choosing a Builder

Not every white-label provider suits every business model. To build a secure, scalable, and competitive decentralized crypto exchange, several critical factors should guide your decision when selecting the right partner.

1. Regulatory Compliance

In the United States, regulatory compliance is non-negotiable. Builders should incorporate KYC, AML, and financial reporting mechanisms into their platforms. Choosing a provider familiar with both federal and state-level rules reduces operational risk, safeguards investors, and ensures smooth entry into a tightly monitored financial environment.

2. Customization and Scalability

A competitive crypto exchange must grow alongside user demands. Select a builder offering customizable features, token integrations, and scalable architecture. This ensures your platform can expand with rising trading volumes, new asset classes, and evolving market trends—delivering long-term adaptability without requiring frequent and costly system overhauls.

3. Security and Reliability

Security breaches have historically damaged trust in crypto markets, making reliability critical. A builder should provide bank-grade encryption, DDoS protection, cold wallet storage, and multi-signature authentication. Proven uptime records and disaster recovery plans ensure that your white label crypto exchange software remains operational, trustworthy, and resilient even during unexpected challenges.

4. Features and Functionality

Not all exchanges are built the same, so functionality matters. Advanced trading options, liquidity management, staking modules, and user-friendly interfaces enhance engagement. Evaluate whether the builder’s platform supports evolving crypto use cases like DeFi and NFTs. A well-rounded feature set determines long-term competitiveness and customer retention.

5. Cost and Time to Market

Launching quickly without overspending is a priority for most businesses. Compare builders by pricing models, available deployment speed, and support services. Some crypto exchange development companies deliver affordable turnkey solutions, while others offer premium, enterprise-level systems. Choosing the right balance ensures sustainable growth while capturing market opportunities at the right time.

Conclusion

Selecting the right white label crypto exchange builder in the US is a strategic decision that influences speed, compliance, scalability, and market credibility. With the US market poised to grow from USD 11.95 billion to USD 70.76 billion by 2030 and institutional participation rising sharply, the right provider can unlock significant opportunity.

Whether you prioritize regulatory readiness, advanced features, or rapid deployment, the companies profiled offer compelling options. By aligning platform capabilities with your business objectives, you can confidently leverage the momentum of the digital asset revolution.

Talk With Our Expert

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment