Table of Contents

Home / Blog / Cryptocurrency

A Complete Guide to Crypto Derivatives Exchange Development

December 9, 2024

December 9, 2024

Launching a crypto derivative exchange is a particularly rewarding move for most businesses. As cryptocurrency adoption continues to grow, many people are in search of more advanced trading features, giving you the opportunity to meet those demands.

However, successful crypto derivative exchanges must have specific, unique features while supporting different types of trades, such as futures, swaps, and options.

In this article, we share Debut Infotech’s end-to-end crypto derivatives exchange development process with you to help you tick all the right boxes in the implementation process.

But first:

What are Crypto Derivatives?

Crypto derivatives are financial contracts that are intended to be executed based on the potential price movements of underlying cryptocurrencies, such as Ethereum or Bitcoin.

When trading these contracts, two traders agree to buy or sell a particular cryptocurrency at a certain price on a specific date. Based on this agreement, the coin’s actual market price on the set date doesn’t matter, as the trade will be executed at the pre-agreed price. This is how they make losses or profits because the profit or loss is obtained from the difference between the contract price and the actual price.

Without really owning the cryptocurrency, they enable traders to make predictions about price movements. In essence, crypto derivatives are bets on the future rise or decrease of a cryptocurrency’s price.

There are different types of crypto derivatives, and some of them include the following:

- Futures: A futures contract is an agreement to purchase or sell a certain quantity of cryptocurrencies at a fixed price on a given date in the future.

Here’s how they operate.

Let’s say you agree to purchase Bitcoin at a price of $30,000 in three months. So, if that price rises beyond $30,000 in three months, you’ll be earning the difference between the actual price at the time and the initially set $30,000. Likewise, you’ll be suffering a loss if the actual price in three months is less than $30,000 because you’ll still be obliged to purchase at $30,000.

- Options: Unlike futures, options only grant the buyer the right, but not the responsibility, to purchase (call) or sell (put) an asset at a predetermined price before or on a given date. So, basically, when you enter an options contract, you literally have the option to execute the trade, but you can decide not to.

If the earlier agreement to purchase at $30,000 were an options contract, you could exercise your call option to purchase Bitcoin at a lower price and sell at a higher market price for a profit if its market value increases to $35,000.

- Perpetual Swaps: Perpetual swaps are just like futures contracts with no expiration dates. This means you get to maintain your position for as long as you choose. As such, they allow a greater degree of leverage than traditional futures contracts. More so, they can be more liquid than the spot cryptocurrency market.

A funding rate method that fluctuates in response to market conditions keeps the price of perpetual swaps around the spot price of the underlying asset.

- Forward Contracts: These are similar crypto derivatives involving two parties who agree directly to purchase or sell an item at a given future date and price.

After the contract has been agreed upon, it works just like a futures contract. However, it differs from futures in that it is negotiated directly between parties, allowing for customized conditions, while futures are standardized contracts.

Furthermore, forward contracts are traded over-the-counter (OTC), while futures are traded on exchanges.

- Binary Options: Depending on whether a condition is met, binary options provide fixed rewards (e.g., if Bitcoin will reach a certain price). You lose your investment if your prediction is wrong, but you get a set reward if it’s right.

Most of these types of crypto derivatives trades are effected on a specialized platform known as a crypto derivatives exchange.

Let’s find out more about these specialized platforms below.

What is a Crypto Derivatives Exchange?

In simple terms, a crypto derivatives exchange is a specialized trading platform that provides the infrastructure required to execute some of the crypto derivatives trading strategies explained above.

Instead of trading actual cryptocurrencies, a crypto derivatives exchange makes it easier to trade financial contracts based on future price changes. In the same way that a betting platform lets you place bets on sports results without owning the teams, this kind of exchange enables traders to speculate on price movements without actually owning the underlying assets. So, unlike traditional crypto exchanges where traders have to actually purchase or sell crypto assets like Bitcoin or Ethereum, crypto derivatives exchanges only facilitate the trading of financial contracts.

This mechanism allows traders to place high-stakes wagers on cryptocurrency prices while employing various tactics, such as leveraging their positions for increased exposure or hedging against possible losses. In essence, crypto derivatives exchanges provide the infrastructure for these trading activities, letting users implement intricate strategies without having to own the actual cryptocurrency.

So, if they’re not facilitating the ownership of actual crypto assets, how do crypto derivatives exchanges generate revenue?

They use the following channels:

- Trading Fees: Most exchanges charge fees for every transaction that takes place on their platform. The charge may be a set sum or a proportion of the trade’s value.

- Margin Trading Fees: Margin trading involves using leverage to enhance the size of trading positions. Anytime a trader takes this option on a crypto derivatives exchange, the exchange charges interest on the borrowed amount, thus boosting the exchange’s revenue.

- Subscription Fees: Certain platforms provide extra premium trading features or services for added subscription fees.

- Staking and Lending Fees: Platforms may provide lending services where users may borrow money for a fee or staking services where users can earn interest on their holdings.

- Deposit and Withdrawal Fees: Exchanges could charge small fees when consumers deposit or withdraw money from their accounts.

Get a Future-Ready Trading Platform

Launching a crypto derivatives exchange can help you unlock multiple revenue streams, from transaction and staking fees to deposit and trading fees.

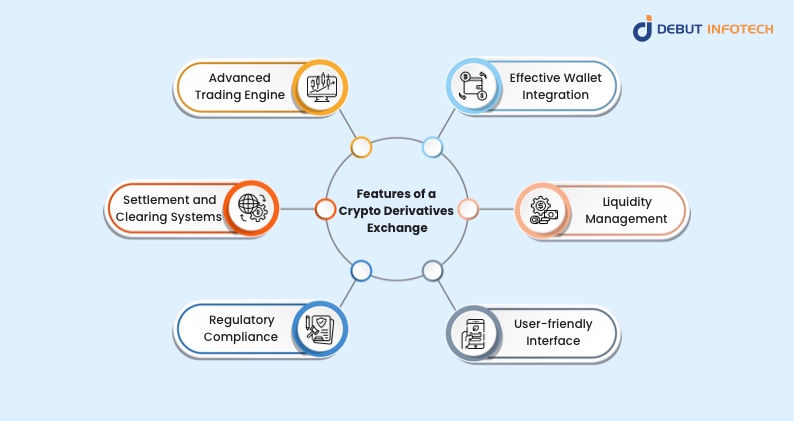

Features of a Crypto Derivatives Exchange

Crypto derivatives exchanges come with numerous elements that improve user experience, guarantee security, and encourage effective trading. These essential characteristics are more prominent in successful cryptocurrency derivatives exchanges. Some of them include the following:

1. Advanced Trading Engine

The core of any cryptocurrency derivatives exchange is the trading engine. It is in charge of carrying out trades, keeping the order book up to date, and matching buy and sell orders.

This high-performance trading engine ensures the platform executes orders and contracts rapidly so that it can guarantee low latency—an essential feature in the quick-paced crypto market. For instance, futures contracts with set dates must be executed at the exact dates so that traders can quickly take their profits or stop their losses before any rapid price changes in the market. This efficiency is comparable to a well-tuned automobile engine; the more smoothly it operates, the better the exchange performs as a whole.

2. Effective Wallet Integration

A quality crypto derivatives exchange is supposed to make sure that traders can deposit and withdraw money without ever leaving the platform, thanks to efficient wallet integration. Successful exchanges usually feature cold wallets (offline) for increased security and hot wallets (online) for speedy transactions.

Furthermore, they protect the funds of platform users using two-factor authentication and multi-signature wallets, which ensure that only authorized transactions are carried out.

3. Settlement and Clearing Systems

A well-designed settlement and clearing system is crucial for effectively managing the risks involved in trading derivatives. This is how the exchange ensures that the funds are correctly sent to the trader’s accounts at the right time after executing a trade.

In addition, this technology automates margin computations and guarantees precise and speedy deal matching. By managing these procedures effectively, exchanges can minimize possible issues and offer traders a seamless experience.

4. Liquidity Management

Liquidity is also another crucial factor affecting how easy it’ll be for traders to execute a trade.

To maintain tight bid-ask spreads and deep order books, cryptocurrency derivatives exchanges frequently use market-making techniques or collaborate with liquidity providers. This improves overall market efficiency by guaranteeing that traders may enter and exit positions easily.

5. Regulatory Compliance

Like every other crypto exchange, the activities on a crypto derivative exchange platform must comply with the dictates of the relevant regulatory bodies. This compliance is crucial for maintaining the validity of operations and building user trust.

To stop illicit activity, cryptocurrency derivatives exchanges usually follow Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. This dedication to compliance safeguards users and improves the exchange’s standing in the marketplace.

6. User-friendly Interface

A user-friendly interface is key to attracting and retaining both seasoned and inexperienced traders. Thanks to accessible trading tools, simple navigation, and intuitive design components, users can swiftly make well-informed judgments.

Features like real-time market data, sophisticated charting tools, and configurable dashboards also facilitate a good trading experience. The key is to ensure that users can find their way around the platform and execute their desired actions seamlessly.

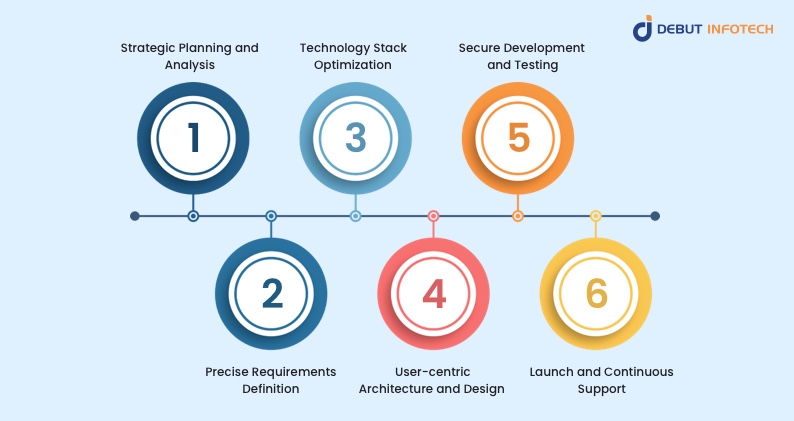

How to Launch a Crypto Derivatives Exchange:

Debut Infotech’s End-to-End Crypto Derivatives Exchange Development Process

As we have highlighted earlier, your business can leverage multiple income streams by supporting advanced traders with a custom crypto derivative exchange platform. If you would like to be a part of this future of digital assets, you can launch cutting-edge cryptocurrency exchange development solutions by following the steps itemized below:

1. Strategic Planning and Analysis

The first and arguably the most important step in the development of a crypto derivatives exchange development process is the initial planning and analysis. This step is crucial for setting the direction for your crypto derivates exchange platform and guides the entire development process.

Suppose you partner with a top cryptocurrency exchange development company like Debut Infotech. In that case, you’ll have access to a team of experts who’ll comprehensively analyze your business objectives, target audience, and compliance requirements. Additionally, they’ll create a clear and detailed roadmap for developing your crypto exchange. Competitor and audience research and insights will inform this roadmap to ensure that your business spots opportunity gaps in the current market and exploits them accordingly.

2. Precise Requirements Definition

Based on the initial analysis, you should have a clear idea of the project’s functionality requirements. If there are any market gaps your business aims to fill in terms of features and functionalities your crypto derivates exchange platform aims to have over others, this is the point to list out the requirements and tools needed to fill that gap.

The experts detail every essential feature and functionality that must be included in the platform to ensure that it meets the projected business goals and objectives. Furthermore, you should prioritize the key components needed to ensure efficiency during the development process.

In summary, this step involves listing what the platform needs to have or do to meet its business goals.

3. Technology Stack Optimization

Now that you have an idea of what you need to achieve your business goals, you need to assemble the tools needed to help you implement those functionalities. These include high-performing databases, tools, and blockchain platforms that match your intended structure and architecture for your crypto derivatives exchange.

Most times, the technology stack you would be assembling should be focused on implementing a robust foundation guaranteeing robust security, scalability, and scalable performance for sustainable platform growth.

4. User-centric Architecture and Design

Having assembled the right tools and technology stack for excellent project execution, the experts at Debut Infotech proceed to design a simple and scalable architecture for your crypto derivatives exchange platform. This is where you implement the essential features of highly successful crypto derivatives exchange platforms, such as user-friendliness, responsiveness, low latency, scalability, and aesthetic features. All these work together to ensure platform users enjoy a smooth, efficient, and visually engaging experience on your platform.

5. Secure Development and Testing

This stage involves the platform’s actual building or development process. Developers and engineers write code to create the platform’s components and core functionalities.

The most important consideration here is to test the platform’s security load capacities extensively so that you can be sure that it can hold up under pressure. The ideal situation when you launch is that your crypto derivative exchange will support many users and process thousands of transactions. Therefore, you must conduct rigorous performance and security checks to ensure that you’ve built a reliable and scalable exchange that is capable of performing optimally under rigorous conditions.

Development and testing should be approached with utmost security consciousness to build user trust and a reputation for maintaining data integrity.

6. Launch and Continuous Support

A successful development and testing process means you can go ahead and deploy your crypto derivatives exchange platform to the public domain and start onboarding users. However, this doesn’t mark the end of the development process.

After launch, it is advisable to ensure regular maintenance and platform monitoring so that potential issues can be easily detected. More importantly, you should provide detailed and updated platform documentation.

When you outsource your crypto derivatives exchange development process to a reputable cryptocurrency exchange development company like Debut Infotech, you’ll have access to regular maintenance and system updates that keep your platform compliant and responsive to evolving market demands. Furthermore, if you opt for their white-label crypto exchange products, you’ll enjoy comprehensive user training manuals and documentation materials that make it easy for anyone to use the platform.

Ready to Launch Your Cutting-Edge Crypto Derivatives Exchange Platform?

Debut Infotech has a team of skilled experts on the ground to help you seamlessly build and deploy a custom crypto derivatives exchange platform.

Conclusion:

The unique benefits associated with crypto derivatives trading present a special chance to meet the demand for these advanced trading choices. Through a variety of financial instruments, including futures, options, and perpetual swaps, these exchanges enable traders to make predictions about the price movements of cryptocurrencies without having to hold the underlying assets.

However, to meet these demands, you need a platform with essential components, such as sophisticated trading engines, strong wallet integration, and extensive security measures. More importantly, using the appropriate technology and knowledge is essential for success as the market keeps growing.

Not to worry, our specialty at Debut Infotech is creating scalable, safe, and customizable crypto derivatives exchange platforms that meet your company’s requirements. Our skilled staff offers comprehensive solutions that cover everything from implementing innovative trading functionalities to complying with regulatory norms.

Launch your cryptocurrency derivatives exchange today and work with Debut Infotech to capitalize on the profitable potential in the digital asset market.

FAQs

Q. What is a crypto derivatives exchange?

A crypto derivatives exchange is a platform where crypto traders and investors buy and sell different financial products that derive their value from underlying cryptocurrencies such as Ethereum and Bitcoin. Crypto derivatives exchanges let users bet on price fluctuations without having actually to hold the crypto assets as in traditional crypto exchanges.

Q. What is cryptocurrency exchange development?

Cryptocurrency exchange development refers to the process of building a platform for trading, purchasing, and selling cryptocurrency. To comply with regulatory norms, this process includes creating and implementing the required software architecture, guaranteeing security, and incorporating features that improve user experience.

Q. Which crypto exchange is best for derivatives?

Most popular crypto trading platforms also offer derivatives trading platforms. Some of the best ones include Binance, OkX, ByBit, MEXC, BitMex, and Bitfinex futures.

Q. When did crypto derivatives start?

Crypto derivatives trading started in 2011 in the form of futures contracts based on the price of Bitcoin (BTC).

Q. How does a derivatives exchange work?

Derivative exchanges work when users register, finish the verification process, and deposit money. The exchange allows traders to profit from price changes while efficiently managing risk by matching buy and sell orders, executing deals, and facilitating the settlement process.

Talk With Our Expert

Our Latest Insights

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment