Table of Contents

Home / Blog / Cryptocurrency

White Label Crypto Wallet: The Future of Seamless Payments in E-Commerce

September 1, 2025

September 1, 2025

Introduction

Online shopping is no longer as it used to be. Customers have now adjusted to faster checkouts, lesser charges and payment methods that are in line with their digital way of life. That is why crypto payments continue to increase in popularity as the volume of global crypto payment transactions will exceed $16 billion by 2030.

For e-commerce businesses, adopting a white label crypto wallet is one of the smartest ways to stay ahead. These ready-to-launch wallets let you offer your own branded, secure, and user-friendly crypto payments without the hassle of building from scratch.

In this post, we’ll dive into how white label crypto wallets are reshaping online commerce and why they’re set to be a cornerstone of digital payments in 2025.

The State of Online Payments in 2025

There is a high likelihood that you have used a credit card, bank transfer, or PayPal when making purchases online. These traditional approaches have long occupied a central place in e-commerce. They are familiar but have a couple of disadvantages such as high transaction fees, slow cross-border payments as well as in some scenarios, chargebacks that reduce business margins.

That is why 2025 is so different. Consumers have become interested in faster, less expensive and more secure means of payment. That is where crypto payments are coming in. Allied Market Research estimates that the global count of crypto transactions may reach $5.5 billion by 2033, and this number seems to grow at a rapid pace.

Businesses in the e-commerce industry are taking note. Shopify, for example, has already enabled its merchants to use cryptocurrencies as a payment method via connections with services like Coinbase commerce and BitPay. This provides sellers with greater flexibility, less dependence on banks, and access to an expanding client base that prefers to hold digital assets.

Whether it’s lowering fees, accessing new global markets, or just maintaining pace with customer trends, merchants are beginning to think of digital assets not as a novelty, but as a competitive advantage. This trend is the reason why more online stores are reconsidering their payment plans and looking at alternatives such as white label wallets as a way to keep up.

Traditional Payments: Strengths and Weaknesses

Traditional payments have been the backbone of e-commerce for decades. Shoppers are comfortable with them, and businesses know the systems inside out. Credit cards, bank transfers, and digital wallets like PayPal come with familiarity, trust, and regulatory backing, three strengths that have made them the default option for most online stores.

With this consolation, however, there are trade-offs. Businesses are charged a high fee, which affects their margins. As a case in point, Amazon incurs billions of dollars worth of payment processing fees every year, which will eventually be transferred to the sellers and ultimately to the customers. Chargebacks introduce yet another headache as it creates risks of disagreements and revenue loss. And when it comes to global sales, cross-border transfers are often slow and expensive, making international expansion harder than it should be.

This is exactly where crypto payments begin to shine. By eliminating the need of intermediaries and providing quicker and cheaper transactions, they address most issues that plagued traditional systems. In the world of e-commerce businesses, the only question is not whether to continue using old methods, but how to integrate them with emerging options like white label wallets for e-commerce that will unleash new realms of productivity and consumer confidence.

Crypto Payments: Strengths and Weaknesses

The biggest sell of crypto in eCommerce is fixing what was wrong with traditional payments. Consider how regularly having to pay high transaction fees, delayed settlements, and regional limitations annoy businesses and customers alike. With crypto, a lot of those pain points disappear.

Strengths of crypto payments in eCommerce:

- Lower fees: Unlike credit card networks that take a cut on every transaction, crypto transfers often cost far less, especially for cross-border payments.

- Faster settlement: No waiting days for bank processing. An eCommerce crypto payment can clear within minutes, giving businesses quicker access to their funds.

- Global reach: Crypto isn’t bound by borders, making it easier for merchants to sell to customers worldwide without worrying about currency conversions.

However, it is not a flawless journey. There are some obstacles that have to be gotten through.

Weaknesses of crypto in eCommerce:

- Volatility: Prices can swing quickly, which makes some retailers hesitant to accept payments without instant conversion to stablecoins or fiat.

- Regulation: Different countries enforce different crypto rules, and staying compliant can feel like a moving target for global merchants.

- Consumer education: Many customers still don’t fully understand how crypto wallets or payments work, which can create hesitation at checkout.

A good example of this balance is Shopify’s integration with Coinbase Commerce. Many merchants now accept crypto alongside cards and PayPal, enjoying faster payments and access to global buyers while still keeping traditional options for customers who prefer them.

Ready to Launch Your Branded Crypto Wallet?

Our white-label solution gets you to market fast, secure, and fully customized. Turn your vision into a powerful revenue engine.

White-Label Crypto Wallets Explained

If you have ever made a purchase on an e-commerce site that included a payment option with its own brand, then you have already encountered the concept of the white label model. Consider it as a pre-designed wallet structure that businesses can tailor-fit with their logos, designs, and special features, and not be compelled to construct everything on their own. This is precisely what a white label crypto wallet is, except with digital assets.

Businesses no longer have to spend years (and millions) building their own secure wallet infrastructure. It can be found in a ready-built, plug-in fashion that they can make their own. The result? A customized, streamlined crypto payment interface that feels native to the system.

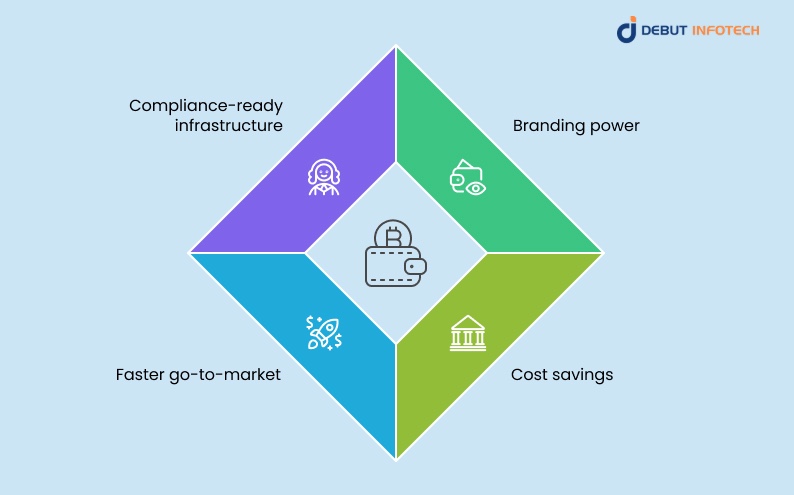

So why does this matter?

- Branding power: Customers interact with your wallet under your name, not a third-party provider. That builds trust and loyalty.

- Cost savings: Developing a wallet from the ground up is expensive. White-label solutions cut costs while giving you enterprise-grade tech.

- Faster go-to-market: Yo⁸u can launch in weeks, not years, which is crucial in a competitive e-commerce landscape.

- Compliance-ready infrastructure: Many providers build in KYC, AML, and regulatory features, helping businesses stay on the right side of global finance rules.

We have already observed successful instances of this in practice. As an example, Binance Pay enables merchants to execute crypto payments with ease, and BitPay has established itself as the firm that provides businesses with integrating ready-made crypto checkout features. Both are reflective of the white-label strategy in which companies do not reinvent the wheel, but rather, they brand and amplify proven, existing infrastructure to the benefit of the company.

To put it simply, white-label wallets will eliminate the technicalities of crypto payments, so that e-commerce brands can concentrate on what is really important, which is delivering smooth, trustworthy shopping experiences that make customers want to come back.

Why White-Label Wallets Are the Game-Changer in E-Commerce

Today consumers demand fast service but they also need payment systems which they can rely on. A white-label wallet enables this by providing e-commerce brands with a fully branded experience. Rather than directing clients to a third-party platform, companies can keep the entire experience within their own brand and create brand loyalty and inhibit drop-offs.

The best part? You do not need to waste valuable years putting up your own blockchain infrastructure. Through the help of crypto wallet development services, retailers will be able to use ready-made frameworks that are securely tested and proven to be fast, but are also open to brand customisation through features.

White-label wallets also create opportunities for special incentives. Consider ways outside of normal payments like reward tokens, loyalty points, or discounts in stablecoins that individuals can use immediately at checkout. Such flexibility is no longer just about enhancing user experience; it can result in repeat business and can distinguish future-oriented brands from competitors.

At the end of the day, white-label wallets make payments an opportunity to expand, ensuring retailers that e-commerce becomes a brand-centered approach to engaging users with a secure method of payment.

Crypto vs. Traditional Payments: Side-by-Side Comparison

Speed, cost, and convenience are important to online payment as much as security concerns. Traditional payment methods such as the use of credit cards or bank transfer have been tried and tested over time. However, crypto is shaking things up, providing businesses and buyers with an all-new way to deal with transactions. And here is how they compare with one another:

| Factor | Traditional Payments | Crypto Payments |

| Settlement Speed | Can take 2–5 business days, especially across borders | Near-instant settlement, often within minutes, even for international payments |

| Transaction Fees | 2–4% per transaction, plus hidden bank charges | Often less than 1%, making it more cost-effective for merchants |

| Chargebacks | High risk of disputes and costly chargebacks | Transactions are final, reducing fraud and operational headaches |

| Global Reach | Limited by banking networks and currency restrictions | Accessible worldwide, no matter the country or local bank availability |

| User Adoption | Familiar to most shoppers, widely trusted | Rapidly growing adoption—Statista reports 1 in 10 internet users already use crypto for payments |

| Regulation | Strict oversight but consistent across regions | Evolving regulations—compliance tools are emerging to help businesses stay safe |

In the case of online stores, any additional charges, poor settlement speed, or dispute resolution costs more and annoys customers. That is one of the reasons why numerous enterprises are considering the possibility of crypto payment gateway development, to provide a faster checkout experience, reduced cost, and the ability to serve customers globally.

How to Choose the Right White-Label Crypto Wallet Provider

Choosing a white label crypto wallet provider is not merely about whose features are the most impressive, it is about finding a partner that you can trust to manage your money, security, and scale as your business grows. These are some of the main aspects that should be considered before entering any contracts:

1. Ask the Right Questions Upfront

Don’t be shy about grilling potential vendors. Ask things like:

- How do you handle updates and maintenance?

- What happens if your system goes down during peak shopping hours?

- Do you provide compliance support for different regions?

A responsible provider will be open and will have articulate responses, not empty promises. An example of a satisfactory vendor due diligence strategy is Shopify, which examines partners regarding their reliability, scalability, and compliance prior to integration.

2. Security Should Be Non-Negotiable

When money is involved, security isn’t just a “nice-to-have”, it’s the backbone of trust. The best wallet providers put protection front and center with features like:

- MPC (Multi-Party Computation) wallets that split private keys across multiple parties, reducing the risk of a single point of failure.

- Cold storage options that keep funds offline and away from hackers.

- Decentralized wallet support, so customers who prefer self-custody can transact safely without relying solely on centralized exchanges.

3. Support and Scalability Matter More Than You Think

It’s easy to get caught up in flashy demos, but what happens six months down the line when your app traffic triples? You’ll want a provider who:

- Offers 24/7 customer support (not just a ticketing system that goes unanswered).

- Has a track record of scaling with fast-growing e-commerce platforms.

- Can adapt to new features, like supporting emerging blockchains or tokens, without breaking your existing setup.

Consider it in the same light as a decision to choose a logistics company: Amazon initially had products, but it didn’t get to its current size without an infrastructure that could expand with the company. The same applies to wallet providers.

Future Outlook: What’s Next in Digital Payments

What lies ahead of checkout experiences is something that feels fast, without borders, and free of risk. Here is what is driving that future and how it pertains to e-commerce teams debating between crypto and traditional rails.

- Stablecoins with guardrails. Stripe and PayPal now support USDC and PYUSD, making it easier for customers to pay in crypto while merchants still get settled in dollars. New regulations like the EU’s MiCA are also adding trust by requiring stablecoin issuers to keep clear reserves.

- CBDCs gaining traction. China’s digital yuan has already processed trillions in transactions, and India is expanding its retail CBDC pilots. These government-backed options could soon show up as everyday checkout methods.

- AI for invisible fraud checks. Smarter fraud detection powered by AI means fewer false declines, faster approvals, and a smoother shopping experience.

- Super apps set the trend. Apps like Grab are adding built-in wallets, proving people want payments, loyalty, and rewards all in one place.

In the case of merchants, this transition signals the availability of AI enhanced smart crypto wallets, where stable coins and CBDCs are paired with cards under your label. The result? Faster payments, reduced costs, and a checkout experience that customers already feel confident using.

Want a Wallet That Drives Real User Growth?

Let’s build your secure, feature-packed wallet together. From design to deployment, we handle it all.

Endnote

The traditional payment methods are by no means obsolete, but e-commerce is shifting toward the use of crypto payments and white-labeled wallets. The advantages such as decreased fees, expedited cross-borders transactions, enhanced security services as well as access to new digital-first customers are obvious.

The real news here is that success in this space is not about embracing new technology. It is a matter of finding the right partner to make your vision a reality. A reputable blockchain development company such as Debut Infotech will help you through all the stages of launching white-label crypto-wallet, its design, and compliance.

Ready to explore what’s possible? Partner with Debut Infotech, an expert in blockchain and wallet solutions, and transform your payment strategy into a real competitive advantage.

Frequently Asked Questions (FAQs)

Q. What is a white label crypto wallet?

A. A white-label crypto wallet is a ready-to-use wallet that businesses can brand as their own.

Instead of building a wallet from scratch, companies start with a pre-built version. Then, they customize it by adding their logo, colors, and extra features.

It’s a faster, more affordable way to launch a secure crypto wallet that feels unique to the business.

Instead of building a wallet from scratch, companies start with a pre-built version. Then, they customize it by adding their logo, colors, and extra features.

It’s a faster, more affordable way to launch a secure crypto wallet that feels unique to the business.

Q. What is a whitelisted crypto wallet?

A. Whitelisting a crypto address means giving permission to specific wallet addresses to use certain functions, services, or smart contracts on a blockchain. Any address that isn’t whitelisted is automatically blocked from making transactions or interactions.

Q. Is white label a good idea?

A. White-label branding is a smart way to enter new markets.

In the past, doing this was often too expensive. Now, brands can cut costs by setting up labeling facilities close to their production plants. This approach reduces shipping expenses and allows them to sell products directly in the market.

In the past, doing this was often too expensive. Now, brands can cut costs by setting up labeling facilities close to their production plants. This approach reduces shipping expenses and allows them to sell products directly in the market.

Q. Can a business have a crypto wallet?

A. A crypto business wallet is a digital tool that helps companies manage their cryptocurrencies.

With it, businesses can securely store, send, and receive digital assets.

With it, businesses can securely store, send, and receive digital assets.

Talk With Our Expert

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment