Table of Contents

Home / Blog / Web Development

Finding the Right Fintech Software Development Company for Your Business

August 18, 2025

August 18, 2025

Do your customers wait too long to have transactions completed? Are you losing out on opportunities due to your technology’s inability to keep pace with the market?

If that resonates, then you should consider fintech, which is an area where efficiency, innovation, and customer satisfaction are the main pillars of existence. By partnering with high-tech software developers, you can transform the way financial services are provided, combining both technological sophistication and innovative thinking.

Whether it is AI-driven credit scoring, blockchain-based security, and personalized digital banking solutions, the tools of modern fintech software development can assist you in getting rid of inefficiencies, tapping new sources of growth, and providing your users with experiences they will trust and enjoy.

The guide will discuss how technology has changed the way of doing things in finance, and will demonstrate how a dedicated software development team can overcome the obstacles that are keeping your institution behind.

Let’s begin!

What is Fintech and How Does It Work?

Financial technology (fintech) is the use of innovative digital technology in financial services and financial analysis to support and improve efficiency. Whether it is peer-to-peer payment applications and digital wealth management technologies or AI-based credit scoring models and cryptocurrency exchanges, fintech is transforming the manner in which individuals and companies manage money.

At its core, fintech is an integration of technology and financial services to streamline transactions and make them smarter and more accessible. It eliminates the old barriers, replacing them with user-friendly platforms that are accessible 24/7, sometimes even cheaper and faster in processing transactions than the older banking infrastructures.

So, how does fintech actually work?

Fintech solutions often combine several advanced technologies, including:

- Open banking & data sharing helps fintech applications to safely integrate with your bank account, review expenditure habits and provide new or improved financial services, e.g., by suggesting that you switch savings plans or take out cheaper loans. This infrastructure is frequently built by specialized fintech software development companies to ensure compliance and security.

- Fraud detection & risk monitoring based on AI-enabled algorithms, help their software analyze thousands of transactions in real time and detect suspicious activity, stopping fraudulent charges before they happen.

- Artificial intelligence and machine learning to provide personalized budgeting advice, identify potentially suspicious behaviour, and automate risk analysis.

- Blockchain and Cryptography to provide transparent, secure and tamper proof transactions.

As an example, buying fractional shares of a stock via an investment app requires fintech to authorize your account, encrypt your financial information, process the transaction in real-time over secure digital networks.

Be it providing freelancers with access to instant payment services or allowing a general user to invest in international markets via their smartphone, fintech is transforming the financial environment into one that is more rapid, secure, and customer oriented.

Related Read: Role of AI in FinTech and Payment Services

When these strengths are coupled with your business objectives, partnering with experienced fintech app development companies will unlock the possibilities of fintech product development, providing secure, intuitive, and scalable products that encourage users to build long-lasting relationships with you as a provider.

What is Financial Software Development?

Development of financial software involves creating and developing digital solutions that streamline, coordinate, and improve financial tasks. This encompasses the development of applications and platforms to meet a wide range of needs in the financial domain, which includes mobile investment portals, digital lending platforms, automatic accounting systems, wealth management systems, and fraud prevention systems. The aim is to use technology to achieve operational efficiencies, make transactions safe and provide a seamless user experience to both individuals and businesses.

Financial software development, in its core, addresses the peculiarities of the financial sector, dealing with large volumes of sensitive information, compliance with a heavy regulatory environment, and applying a high level of web development security protection. Such solutions are usually developed by highly qualified fintech software developers that have extensive expertise in regulatory compliance, cybersecurity, and intricate financial procedures.

Transform Finance with Cutting-Edge Software!

Debut Infotech builds secure, scalable fintech solutions that accelerate growth, streamline transactions, and future-proof your business. Turn possibilities into profit.

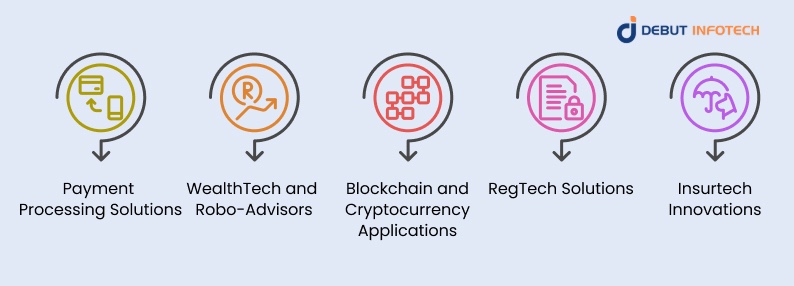

Types of Fintech Software Development

Fintech offers a wide variety of financial solutions including payments and lending, investments and insurance, each of which needs specific expertise with fintech developers. Let’s explore the core categories and what makes these applications impactful and efficient.

1. Payment Processing Solutions

The most fundamental application of fintech is payment processing, which enables businesses and customers to process secure, fast, and reliable payments. These solutions address issues of authorization, financing, and payment settlement, with multiple payment options, such as credit cards, debit cards, digital wallets, and bank transfers. One of the well-known examples is Stripe, often implemented by experienced fintech software developers.

Key features of advanced payment processing solutions include:

- Real-time transaction completion, boosting customer satisfaction.

- Machine learning algorithms for fraud detection and prevention.

- Multi-currency support, enabling smooth international transactions.

- Seamless integration with e-commerce platforms and financial systems for an uninterrupted payment experience, frequently handled by specialized web development companies.

2. WealthTech and Robo-Advisors

WealthTech apps are aimed to automatize the management of investments, monitor portfolios, and financial planning with the help of AI-advised recommendations. Robo-advisers such as Betterment facilitate automated investment plans according to goals and risk acceptance of the user.

Key features include:

- Algorithm-based portfolio management and rebalancing.

- Goal-based investment tracking.

- Risk profiling and diversification suggestions.

- Access to real-time market analytics and insights.

3. Blockchain and Cryptocurrency Applications

The blockchain technology is a decentralized and secure mechanism of documenting transactions, increasing transparency, and mitigating threats of fraud. Cryptocurrencies like Cardano and Litecoin use blockchain to enable peer-to-peer transfers without a middleman.

Core features of blockchain and cryptocurrency applications:

- No central authority, lowering risks of manipulation and fraud.

- Publicly accessible transaction records, fostering trust and accountability.

- Cryptographic protections to ensure transaction integrity and privacy.

- Smart contracts that automatically execute once predefined conditions are met, boosting efficiency and reducing manual intervention.

4. RegTech (Regulatory Technology) Solutions

RegTech solutions enable financial institutions to meet regulatory requirements effectively as they simplify the compliance verification process, track potential fraudulent transactions, and produce the necessary reports. They are particularly significant in regulatory intensive industries. One such company is ComplyAdvantage.

Key features include:

- Real-time monitoring to detect and flag suspicious transactions.

- Automated compliance reporting for various jurisdictions.

- Risk scoring and customer due diligence (KYC/AML).

- Integration with existing banking or financial systems for seamless compliance workflows.

5. Insurtech Innovations

Insurtech is focused on the modernization of the insurance sector, including underwriting and claims systems, as well as personal insurance. These innovations increase the availability and accessibility of insurance. One clear example is Hippo Insurance.

Common features of Insurtech solutions include:

- AI-powered risk assessment for personalized coverage options.

- Online claims submission and tracking for faster resolution.

- Dynamic premiums based on real-time data like driving behavior or home sensors.

- Engaging policyholder interactions through mobile apps and digital portals, reflecting current web development trends.

Top 5 Fintech Software Examples

Fintech has kept reinventing several areas of finance, it is changing how we save and invest, how we insure and make payments. The following are five fintech software solutions that show the depth and power of this sector.

1. Wise (formerly TransferWise)

Wise has transformed the entire experience of how people and companies transfer money across borders. Its ability to operate using actual exchange rates and levying low and transparent charges makes international transfers easy and cheaper than they would be in conventional banks. Businesses looking to replicate this success often leverage specialized fintech app development services.

2. Acorns

Acorns is also an easy way to invest because it rounds up each of your daily expenses and then adds the extra change to diversified portfolios. Its micro-investing platform is especially attractive to new users seeking a low-entry opportunity into investments.

3. Square

Square provides a line of payment and business management systems that enable small businesses to pioneer card payments anywhere. Whether it be in the form of point-of-sale systems or online payment gateways, its solutions make it a crucial fintech tool to merchants.

4. Monzo

Monzo is an online bank based in the UK that has instant spending notifications, budgeting tools, and no fee overseas spending. It is fully based on a mobile application, a key difference in the web app vs mobile app choice for financial services, making it popular among customers who want the modern banking experience.

5. Hippo

Using a technology-centered approach, Hippo offers quicker quote times, proactive property management services and hassle-free claims. Through smart home technology, Hippo assists customers in averting disaster and you can do all this before it causes expensive damage.

Key Stages in Fintech Software Development

The development of a fintech software product demands serious planning, time and resources, it cannot be developed overnight. The starting point of any startup must be having a clear idea and choosing a niche. Here are the five key steps that should help to make the process more efficient:

1. Gather Project Requirements

Begin by conducting an extensive market research to determine who you are targeting, your competitors and sources of potential revenue. The study, crucial for any fintech mobile app development services project, will inform your costing, schedules and general development plan.

2. Design the User Experience

Fintech applications need to be simple and easy-to-use. Clean presentation and easy navigation are essential in maintaining users engaged. Find some inspirations in design, state your preferences, and converse with a UI/UX team to create a precise functional layout.

3. Develop the Software

Identify the major characteristics and establish the project scope. Pay attention to fixing the problem a certain user has and ensuring the ease of adoption. Creating a Minimum Viable Product (MVP) will enable you to experiment with the basic features and improve them later using feedback.

4. Conduct Rigorous Testing

Test your fintech app by using it at the back-end before launch time. Early testing assists in eliminating bugs, avoiding possible problems, and providing smooth performance to the user. Proper fintech development practices are crucial here.

5. Launch and Gather Feedback

Put your software to the market and proactively gather the real user feedback. Based on these, decide what to improve, eliminate, or add.

In case you have an idea of fintech yet lack the in-house capacity to realize this idea, working with a recognized development partner such as Debut Infotech is key to converting your idea into a high-performance and market-ready solution.

How Much Does Fintech Software Development Cost?

The question most often asked during the startup of a fintech project is, how much will this cost to build? Although no common figure can be mentioned, being aware of the key drivers of costs can assist in planning your budget more effectively.

Custom fintech software development can be estimated as anywhere between $50,000 to more than $500,000 based on the complexity of the project, features, and the nature of the application. To give a simple example, an app that allows peer-to-peer lending will not be as expensive as developing a full-fledged blockchain-based remittance platform or a machine-based learning algorithm that performs fraud detection, though both significantly impact the final web application development cost.

Key factors influencing fintech software development costs include:

- Tech Stack: The choice of frameworks, languages, and databases affects both development speed and overall expenses.

- UI/UX Design: In fintech, intuitive and secure design is crucial. While a polished interface might slightly increase upfront costs, it significantly boosts user trust and long-term engagement.

- Development Team Location: Developers in regions such as North America or Western Europe usually charge more than equally skilled teams in Southeast Asia or Eastern Europe.

- Compliance and Security: Meeting regulations like PSD2, GDPR, or KYC/AML adds complexity, requiring extra development time and specialized expertise.

- Scope and Complexity: Features such as instant fund transfers, multi-currency support, biometric verification, or advanced analytics will raise development costs.

Minimizing expenses on fintech software development may be dangerous as nothing should be compromised when it comes to the reliability, security, and performance of this industry sector. A well-drawn Minimum Viable Product (MVP) can serve as a smart approach to deploy more quickly, validate the market and scale without compromising either quality or compliance.

Pros and Cons of Fintech Software Development

Having considered what fintech is and how a fintech software is developed, it is as well important to consider the pros and cons of fintech before proceeding. The growing technology of financial services through fintech software development has redefined the financial services industry with enormous opportunity but also posing exclusive challenges. Its advantages and disadvantages are shown below:

| Pros | Cons |

| Real-time transaction processing | Dependence on internet connectivity |

| Global market reach | Data privacy compliance challenges (e.g., GDPR, CCPA) |

| Scalability for growing user bases | Frequent need for software updates and maintenance |

| Data-driven insights for better decision-making | Risk of technical downtime or service outages |

| Integration with emerging technologies like AI, IoT, and blockchain | Potential resistance from traditional financial institutions |

| Ability to offer niche financial products (e.g., micro-loans, digital wallets) | Higher customer acquisition costs in competitive markets |

Technology Stack for Fintech Software Development

To enable your fintech platform to run optimally in terms of performance levels, security issues, and scalability, it is very important to ensure that the correct technology stack is being used as part of the project. A stable stack enables the handling of bulk data, manages sensitive data and ensures an excellent user experience. The following table contains some of the relevant tech stacks:

| Component | Technologies / Tools | Purpose |

| Backend Technologies | Go, C#, Kotlin, Django | Secure, high-performance server-side development with flexibility and scalability. |

| Frontend Technologies | Svelte, Ember.js, Backbone.js | Create responsive, interactive, and user-friendly interfaces for fintech applications. |

| Databases | MariaDB, CockroachDB, Cassandra, Memcached (caching) | Store, manage, and retrieve financial data securely and efficiently. |

| Cloud Computing | IBM Cloud, Oracle Cloud, Alibaba Cloud | Provide scalable infrastructure, high availability, and compliance-ready environments. |

| Blockchain & Cryptography | Corda, Quorum, libsodium | Enable secure, transparent transactions and protect sensitive data. |

| AI & Machine Learning Tools | H2O.ai, Microsoft Cognitive Toolkit (CNTK) | Deliver fraud detection, risk assessment, and personalized financial services. |

| Payment Gateways | Stripe, Adyen | Facilitate smooth, secure, and compliant payment transactions globally. |

Fintech Development Ahead: Market Insights and Innovations Shaping the Future

The ever-evolving technological landscape has contributed to the development of the fintech software market to meet the changing customer demands. A report published by Grand View Research in 2021 projected the global neobanking market to reach USD 722.60 billion by 2028 with a CAGR of 47.7 percent between 2021 and 2028.

Here are several current trends transforming fintech software development for fintech:

- Rapid global adoption of digital wallets: The total volume of digital wallet consumers across all countries of the globe is projected to reach beyond 4 billion by 2024, which points to the mass consumer transition to cashless and contactless payment methods.

- Robotic Process Automation (RPA) gaining ground: Approximately 80% of the leading financial executives are enforcing or considering RPA to increase productivity and eliminate mistakes in operation related areas such as accounting, transaction processing, and reporting.

- Cloud-native and microservices-led architectures are becoming core components of the modern tech stack for web development in finance: More than 75% of financial institutions will likely implement the use of public cloud by 2025. Companies that employ microservices indicate a 20-30% rise in deployment rates compared to more classic structures, which brings about higher agility and scalability.

- AI and ML powering hyper-personalization and fraud detection: It is estimated that the worldwide fintech AI market will expand to $26.67 billion by 2027, with financial institutions using machine learning to provide customized services and more intelligent threat prevention.

- Embedded finance becoming mainstream: The embedded finance economy is growing fast, allowing the provision of financial services such as lending, savings and payments to be embedded within non-financial platforms, creating new user experiences across industries

Ready to Revolutionize Financial Services?

Partner with our fintech experts to craft custom software for payments, banking, or crypto. Let’s engineer growth together.

Final Thoughts

Nowadays, fintech is not a choice but a necessity to promote growth and innovations within the financial sector.

At Debut Infotech, a premier web development company, we have developed high-performing, secure, and scalable fintech solutions for fintech web development over a decade. Be it an initiation of a new platform or renovating an existing one we combine such technologies as blockchain, AI, and advanced analytics to produce the outcome that could satisfy global requirements.

Let’s turn your fintech vision into a future-ready product today!

Frequently Asked Questions (FAQs)

Q. What is fintech software development?

A. Fintech software development focuses on building and maintaining innovative digital solutions for the financial industry. From online banking and mobile payments to digital wallets, peer-to-peer lending, investment platforms, and blockchain applications, these technologies are designed to make financial services faster, safer, and more accessible.

Q. What is a fintech mobile app?

A. Examples include mobile payment platforms like Venmo and international money transfer services like Wise. Personal finance management (PFM) apps go further by helping users track expenses, set budgets, and gain valuable insights into their spending patterns.

Q. Does fintech use AI?

A. In fintech, AI powers smarter fraud detection, accurate credit scoring, efficient algorithmic trading, and personalized chat-based customer support.

Talk With Our Expert

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment