Table of Contents

Home / Blog / Cryptocurrency

DEX Aggregators vs. Standalone Decentralized Exchanges: Key Differences

August 12, 2025(Updated: January 20, 2026)

August 12, 2025(Updated: January 20, 2026)

Are you trying to make the right choice between building a crypto exchange aggregator or a standalone decentralized crypto exchange platform?

That’s a smart thing to do because making the right pick can determine your market success.

So, which one will it be? One offers speed and reach; the other, control and customization.

Eager to find out which is which?

This article breaks down their core differences — from liquidity and user experience to scalability and risk — providing crypto executives, founders, and decision-makers with a clear roadmap to choose the right path for their vision.

As a seasoned decentralized crypto exchange development company, we at Debut Infotech have built both these exchanges and identified the best choices for various situations. We’re about to share our insights with you in this article.

What is a Standalone Decentralized Crypto Exchange (DEX)?

As the name implies, a standalone decentralized exchange (DEX) is an independent, decentralized exchange built to facilitate cryptocurrency trading among different entities without the assistance or control of a centralized authority. The fact that there are no intermediaries in these blockchain-based platforms means that crypto traders can participate in peer-to-peer trading, exchange crypto assets directly with anyone from anywhere, as long as they match their trading requirements.

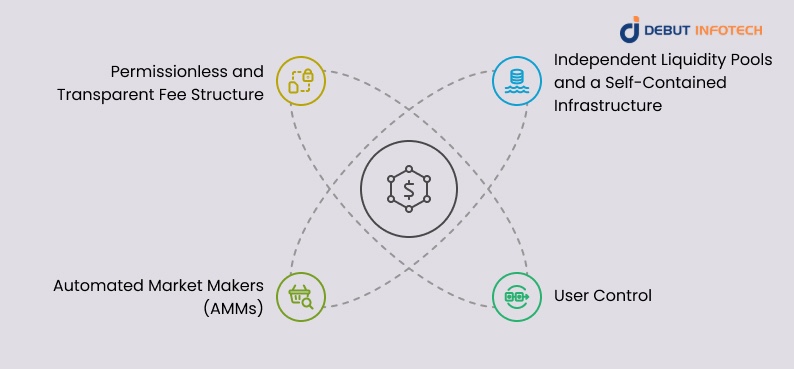

Standalone DEXs facilitate these independent peer-to-peer crypto trades by maintaining their native liquidity pools and enforcing trade agreements with the use of smart contracts. For executives or founders looking to launch a standalone decentralized exchange, here are some core features every standalone decentralized exchange should possess:

- Independent Liquidity Pools and a Self-Contained Infrastructure: Your standalone DEX must have its own liquidity pool, trading interface, and backend logic.

- User Control: Traders must be able to maintain full control of their asset ownership, i.e., they shouldn’t have to deposit their crypto assets into a central wallet.

- Automated Market Makers (AMMs): These are “algorithmic money bots” that set token prices based on the laws of demand and supply within the cryptocurrency market. A standalone decentralized exchange (DEX) must be able to facilitate trades and provide liquidity using its AMM.

- Permissionless and Transparent Fee Structure: Anyone with a viable crypto wallet should be able to interact with the DEX, and all activities should be publicly recorded on the blockchain network.

In short, a standalone DEX gives you autonomy, branding, and infrastructure — but also full responsibility for liquidity, growth, and security.

What are DEX Aggregators?

On the other hand, a DEX aggregator is a crypto trading platform that facilitates crypto trades by connecting multiple (standalone) decentralized exchanges (DEXs) in order to find the best possible trading conditions and rates across all of them.

You probably guessed what a cryptocurrency exchange aggregator stands for from its name; it literally aggregates multiple standalone DEXs.

As such, instead of pulling liquidity from a single DEX, a DEX aggregator intelligently routes trades across multiple exchanges to achieve better prices, lower slippage, and improved gas efficiency.

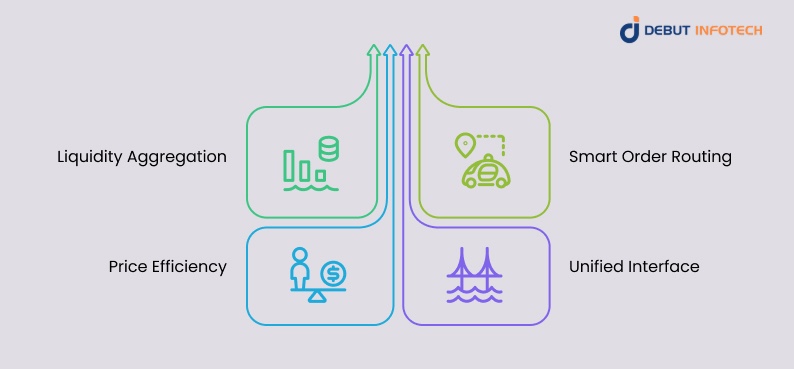

For executives and crypto exchange founders looking to build a DEX aggregator, there are some unique features every DEX aggregator worth its salt needs to have. Some of them include the following:

- Liquidity Aggregation: A DEX aggregator must be able to access the liquidity pool of different DEXs, pull liquidity from them, and secure the best available prices for users trying to execute a trade.

- Smart Order Routing: The DEX aggregator must be able to split trades across different DEXs to provide traders with the best possible rates.

- Price Efficiency: One of the primary reasons users prefer DEX aggregators to standalone DEXs is to ensure they obtain the best price for their trades. A DEX aggregator must be able to guarantee this.

- Unified Interface: Users should be able to access multiple DEXs through a single, unified interface.

In essence, DEX aggregators are the “Google Flights” of crypto trading — they don’t own the liquidity but help users find and execute the best deals.

By now, you must have started gathering some key distinctions between DEX aggregators and standalone DEXs. However, if you’re looking to make an educated choice between these two awesome categories of crypto trading platforms, you need to be informed on some more intricate differences.

Let’s dive deeper into these in the next section.

Build an industry-standard decentralized exchange today!

Work with our experts to launch a best-in-class crypto exchange aggregator or standalone crypto exchange.

Key Differences Between DEX Aggregators and Standalone Decentralized Exchanges

Here are the key differences between DEX aggregators and standalone decentralized exchanges at a glance:

| Key Differences Between DEX Aggregators and Standalone Decentralized Exchanges at a Glance | |||

| Aspect | DEX Aggregators | Standalone DEXs | Main Takeaway |

| 1. Liquidity & Slippage | Pulls liquidity from many exchanges at once, splitting orders to get the best price with minimal slippage. | Uses only its own liquidity pools, which can mean more slippage if those pools are small or unbalanced. | Aggregators excel in liquidity reach; standalone DEXs rely on building deep in-house pools. |

| 2. User Experience | One dashboard to see prices, swap tokens, and get the best deal automatically. | Each DEX has its own interface, and users must manually shop around for better rates. | Aggregators make trading simple; standalone DEXs offer unique but sometimes clunky experiences. |

| 3. How They Earn & Manage Costs | Makes money from routing trades (small fees, partnerships) and saves users money through gas and price optimization. | Makes money from trading fees that go to liquidity providers; trade costs depend on how much liquidity is available. | Aggregators focus on efficiency and volume; DEXs earn from their own liquidity activity. |

| 4. Technical Build | More complex — integrates with many protocols and uses smart routing logic. | Self-contained — runs its own pools or order book without outside integrations. | Aggregators are harder to maintain; DEXs are simpler but stand alone. |

| 5. Security & Risks | A larger attack surface because it relies on multiple protocols; a partner’s breach can cause significant problems. | All risk resides within one protocol; a single major flaw can drain all assets. | Aggregators face wider but smaller risks; DEXs face narrower but higher-impact risks. |

| 6. Scaling & Flexibility | Easy to add new chains or features by plugging into more protocols. | Scaling means launching new contracts and rebuilding liquidity from scratch. | Aggregators scale faster; DEXs scale slower but allow full customization. |

The following are some of the major differences between the DEX aggregator and a standalone decentralized exchange:

1. Liquidity Sources and Price Slippage

Liquidity means how easily a crypto exchange can execute a trade without significantly affecting the trade’s price. So, basically, different crypto trading platforms typically lock some crypto funds in a smart contract to enable them to facilitate crypto trades when users want to execute them. On the other hand, price slippage occurs when a trade executes at a price different from the expected one, typically due to low liquidity or a large order size.

Standalone DEXs and DEX aggregators differ in their mode of operation, as they obtain liquidity through different means, which in turn affects each platform’s price slippage in distinct ways.

Here’s how:

DEX aggregators resolve the liquidity fragmentation issue by consolidating liquidity from multiple decentralized exchanges. Instead of relying on a single pool, they scan various DEXs to find the best available rates across platforms.

- If liquidity is thin on one exchange, the aggregator can split the order across several DEXs.

- This reduces price slippage, especially on larger trades.

- It results in more competitive pricing for end-users, without requiring them to switch between platforms.

On the other hand, standalone decentralized crypto exchanges rely solely on their own liquidity pools. This can lead to:

- Higher slippage on large or illiquid trades.

- A dependence on user-supplied liquidity, which may fluctuate.

- A more siloed trading experience unless the DEX becomes a major liquidity hub (like Uniswap).

2. User Experience and Trading Interface

In the context of DEX crypto exchanges, user experiences refer to how intuitive, efficient, and accessible the trading experience is for every crypto trader who logs on to the platform. This experience is closely dependent on the nature of the trading interface, specifically the number of liquidity pools a trader must interact with before executing a trade.

Considering that DEX aggregators are designed to consolidate multiple DEX crypto exchanges into a single interface, they tend to prioritize simplicity and the speed of executing trades. As such, the trading interface and user experience are typically characterized by:

- A single point of entry to access the best rates from different liquidity pools

- No need to manually compare prices across different platforms

- Features like one-click swaps, slippage control, and real-time price optimization.

Basically, once a trader logs on to a cryptocurrency exchange aggregator, they don’t need to manually check the available deals on different standalone DEXs because they can access all these on the DEX aggregator’s interface.

On the other hand, a standalone DEX typically has a platform-specific interface, each with its own logic and quirks. As such, users often need to:

- Manually compare prices on other DEXs.

- Face limitations in functionality, especially with smaller or newer DEXs.

- Navigate unique UI/UX flows, which can vary significantly across protocols.

3. Revenue Model & Cost Efficiency

Clearly, both DEX aggregators and standalone DEXs need to sustain their activities by generating revenue.

However, they approach it in slightly different ways, and these differences tend to impact the cost efficiency of every trade for the users.

Here’s how these different exchanges differ in terms of revenue model and cost efficiency:

DEX aggregators typically DO NOT have native liquidity sources; instead, they source liquidity from various sources. As such, their main revenue sources include:

- Aggregator fees: A small markup on top of routed trades.

- Referral or partner incentives with underlying DEXs.

- Optional premium features or white-label integrations for B2B users.

So, how do these revenue sources impact cost efficiency for traders?

Remember, we mentioned earlier that DEX aggregators typically compare prices across different liquidity sources to get the best possible trading conditions for their users? As a result, aggregators tend to focus on gas optimization using any of the following strategies:

- Splitting trades across the cheapest paths using smart routing

- Reducing slippage and unnecessary transaction fees

- Offering a lower cost per trade, particularly for large orders.

On the other hand, standalone decentralized crypto exchanges, because they own and run their own liquidity pools, typically generate revenue through Liquidity Provider (LP) fees, which is a fixed percentage per trade, and native token initiatives.

As such, without aggregator-level routing in a standalone DEX, users may:

- Pay higher gas fees.

- Suffer worse execution prices if liquidity is thin.

Related Read: Crypto Exchange Development for Institutional Investors: Key Features Needed

4. Technical Architecture

How about the underlying structure, integrations, and smart contracts that power the trades on each of these platforms?

Since both cryptocurrency exchanges execute trades via different processes, they do have different technical architectures.

For example, a crypto exchange aggregator generally has an integration-heavy system because it needs to connect with different decentralized exchanges. As such, the technical architecture of a crypto exchange aggregator is typically more complex, as it must ensure seamless routing without execution failure, handle edge cases, and maintain compatibility with the various protocols used across different exchanges.

A DEX aggregator’s technical architecture generally includes the following:

- Smart contracts for interacting with multiple crypto exchanges

- Routing algorithms for identifying the best trade execution paths

- APIs and middleware for cross-chain compatibility

- Optional frontends that aggregate pricing, slippage data, and gas estimates in real time.

On the other hand, standalone DEXs generally have a simpler technical architecture because they typically maintain a self-contained ecosystem. Nonetheless, regardless of how simple the infrastructure might be, the following are some core components every standalone DEX must possess:

- Smart contracts for its native liquidity pools and swap logic (AMM) or order blocks

- A single-protocol design focused on its own liquidity

- Frontend/UI built specifically for its trading model.

In general, aggregators have more complex, integration-driven architectures that require continuous updates and support for multiple protocols. Standalone DEXs, on the other hand, operate simpler, single-protocol systems, but bear full responsibility for managing and securing liquidity in-house.

5. Security, Risks, and Smart Contract Structure

Speaking of security, the varying number of integrations in both categories means each has different risk probabilities. Founders and executives considering any of these decentralized crypto exchange development processes must be aware of these risks, as security is business-critical, and a single smart contract vulnerability could potentially lead to the loss of funds and erode user trust.

So, which crypto exchange poses more security risks?

That’s a relative question.

On the one hand, since DEX aggregators operate as multi-contract, multi-protocol systems, they have a unique set of security considerations, which include the following:

- Smart contract complexity: Integrating with multiple platforms means more code paths, and in turn, increases the potential for vulnerabilities.

- Dependency risk: A crypto exchange aggregator isn’t entirely in control of its vulnerabilities, as compromising one of the integrated DEXs can also affect aggregator users.

- Front-running and MEV exposure: Multiple routing steps can increase attack vectors.

On the other hand, Standalone DEXs manage a smaller, more focused codebase, which can be easier to audit and secure. Nonetheless, they are still open to the following security risks:

- They hold all protocol liquidity in their smart contracts, making them high-value targets.

- A single vulnerability can lead to complete asset loss.

- Security upkeep is fully the builder’s responsibility.

6. Scalability & Flexibility

Scalability and flexibility refer to how well a platform can handle user and trading volume growth, as well as how seamlessly it adopts new technologies, chains, and market trends.

Are you wondering how the inherent nature of the platform affects these things?

The number of integrations a platform has and the rigidity of its native technical infrastructure determine how agile the entire system is in terms of change.

For instance, the fact that a DEX aggregator typically has to be compatible with numerous DEXs makes it inherently flexible. This means that:

- DEX aggregators can add new DEXs or blockchains without disrupting their core systems significantly

- They can also quickly adopt cross-chain functionality and emerging protocols

- Scaling to support more assets or higher volumes often involves upgrading routing logic, not reengineering liquidity mechanisms.

However, they remain dependent on the scalability of the underlying DEXs they integrate with.

For Standalone DEXs, these platforms control their own protocol and liquidity, which can make scaling more resource-intensive:

- Expanding to new chains means deploying entirely new smart contracts and bootstrapping liquidity again.

- Feature upgrades may require core protocol changes, which can be slower due to governance processes.

- Flexibility is higher in design choices but lower in rapid expansion.

Launch a Crypto Exchange Platform that Attracts High-Volume Traders

Contact our crypto exchange developers to build a robust crypto exchange that caters to the needs of all kinds of crypto traders.

Conclusion: Strategic Fit for Crypto Executives and Decision Makers: When to Build What?

So, are you torn between the choices?

Don’t be!

The right choice for your organization between building a DEX aggregator or a standalone DEX should always come down to your strategic priorities.

If your goal is speed, broad liquidity access, and user-friendly execution, an aggregator offers faster market entry and flexibility.

If you want full control, brand ownership, and the ability to innovate at the protocol level, a standalone DEX provides that autonomy; however, it requires more effort to attract and sustain liquidity.

The good news? You don’t have to navigate this decision-making process alone!

With the help of Crypto Exchange Development Company like Debut Infotech Pvt Ltd, you can get expert advice on the best direction. We also specialize in building both high-performance DEX aggregators and secure, scalable standalone DEXs. Whatever path you choose, we can help you design, develop, and launch with confidence.

Book a consultation today!

Frequently Asked Questions (FAQs)

A. Some decentralized crypto exchanges include Uniswap, SushiSwap, PancakeSwap, and dYdX. These platforms enable users to trade directly from their wallets without the need for intermediaries.

A. While a DEX aggregator links to several DEXs and routes trades for the best pricing and less slippage without requiring customers to individually compare each exchange, a DEX is a single exchange with its own liquidity pools.

A. No. Coinbase Wallet is not a decentralized exchange; rather, it is a self-custody cryptocurrency wallet. Nevertheless, users can trade straight from their wallet without making a deposit into a centralized exchange thanks to its integration with DEXs. The wallet itself doesn’t carry out trades or store liquidity.

A. The primary platform of Binance is a centralized exchange (CEX). Although the majority of its trading volume and user activity occur on its centralized platform, where Binance maintains custody of user funds, it also operates the decentralized Binance DEX.

A. Indeed. A decentralized digital currency with no central authority, Bitcoin (BTC) operates on a peer-to-peer network. Without the need for reliable intermediaries, transactions are validated by miners and stored on a public blockchain, ensuring security, transparency, and resilience against censorship.

About the Author

Daljit Singh is a co-founder and director at Debut Infotech, having an extensive wealth of knowledge in blockchain, finance, web, and mobile technologies. With the experience of steering over 100+ platforms for startups and multinational corporations, Daljit's visionary leadership has been instrumental in designing scalable and innovative solutions. His ability to craft enterprise-grade solutions has attracted numerous Fortune companies & successful startups including- Econnex, Ifinca, Everledger, and to name a few. An early adopter of novel technologies, Daljit's passion and expertise has been instrumental in the firm's growth and success in the tech industry.

Our Latest Insights

Leave a Comment