Table of Contents

Home / Blog /

How Machine Learning in Banking is Transforming Operations

May 8, 2025

May 8, 2025

Today, Machine learning in banking is no longer just a future concept with unclear results. It is a prime factor reshaping banking operations, risk-taking, and customer service interactions. As Artificial Intelligence (AI) and Machine Learning are increasingly embraced, the banking sector is undergoing a major upheaval in its approaches to payment processing, tailoring user experiences, and countering fraud. Modern-day financial systems employ an algorithmic machine learning approach that aids the user in real-time decision-making processes by knowledge transfer from the training history, thereby eliminating human interference and minimizing risk while functioning as a catalyst for operational efficiency.

With increased demand for a smarter, faster, and more secure banking transformation, financial institutions are pushing machine learning for banking integration more. From fraud detection to predictive analytics, the possibilities of ML applications are enormous and ever-increasing. In this article, we will delve into the workings of ML in changing the banking world, some of the use cases found in the real world, and the steps required for execution in detail.

Explore More AI & ML Innovations in Finance

Stay ahead of the curve with deeper insights into how AI and machine learning transform financial services and banking operations.

The Growing Role of Machine Learning in Financial Services

Implementing machine learning in financial services is primarily driven by the need for data-driven decision-making, operational efficiency, and risk management. Banks collect vast amounts of data daily—from transactions to customer interactions—and ML systems help uncover patterns and make sense of this data in real time.

Key Benefits Include:

- Speed and Efficiency: Automating routine tasks like document verification and transaction processing.

- Risk Management: Predicting loan defaults and market shifts.

- Cost Reduction: Lowering costs through operational automation.

- Customer Insights: Offering personalized services through customer segmentation models.

As financial machine learning becomes more advanced, banks are expected to rely on it for back-office operations and customer-facing services.

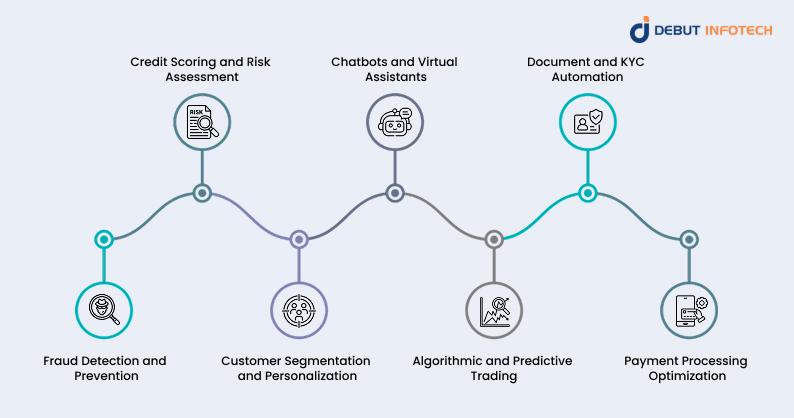

Use Cases of Machine Learning in Banking

Machine learning in banking is driving a new era of efficiency, accuracy, and personalization. By applying advanced algorithms and data analysis techniques, banks can automate operations, enhance customer experiences, and make smarter financial decisions. Below are the most impactful use cases reshaping the banking landscape today.

1. Fraud Detection and Prevention

One of the most critical and mature applications of machine learning in banking is fraud detection and prevention. Financial institutions face an ever-evolving threat landscape, with cybercriminals leveraging increasingly sophisticated methods. Machine learning models help counteract these threats by continuously learning from past fraudulent behaviors and identifying patterns that deviate from the norm.

ML systems can simultaneously analyze millions of real-time transactions, accurately flagging suspicious activities. For instance, if a user typically makes local purchases but suddenly initiates large international transactions, the system can instantly alert fraud analysts or even block the transaction until verified. This approach significantly reduces financial losses and improves customer trust.

- Example: A customer’s card is used simultaneously in two countries—ML flags this as a potential fraud.

- Machine Learning Techniques Used: Supervised learning models trained on labeled fraudulent transaction datasets, deep learning in predictive analytics for anomaly detection.

- Result: Faster detection rates, fewer false positives, and reduced financial risk.

2. Credit Scoring and Risk Assessment

Traditional credit scoring systems are often rigid and limited in scope. They primarily rely on credit histories, employment status, and income, which may not be available for many people, especially in developing economies. Machine learning opens new possibilities by factoring in non-traditional data sources such as utility bill payments, e-commerce activity, mobile usage patterns, and social behavior.

By training Machine Learning Models on broader features, banks can better assess an individual’s creditworthiness and tailor interest rates accordingly. This inclusive approach reshapes the credit landscape and empowers financial access for the underbanked.

- Impact: Broader access to loans for people with limited financial history; reduced default risk through better prediction models.

- Models Used: Logistic regression, decision trees, and ensemble models trained on vast datasets containing historical loan performance.

- Machine Learning in Financial Services Benefits: Risk minimization and increased lending precision.

3. Customer Segmentation and Personalization

Understanding customer behavior is essential for any financial institution that wants to improve engagement and offer relevant products. Machine learning for customer segmentation allows banks to analyze demographic, behavioral, and transactional data to divide users into distinct groups or personas.

Once segmented, banks can provide hyper-personalized offerings, such as custom savings plans, credit card recommendations, or investment strategies. These efforts not only improve customer satisfaction but also enhance the effectiveness of marketing campaigns.

- Tools Used: K-means clustering, Gaussian Mixture Models, and unsupervised learning algorithms.

- Outcome: Better conversion rates, improved brand loyalty, and increased lifetime customer value.

- Example: A customer identified as a frequent traveler is offered travel insurance and foreign exchange benefits.

4. Chatbots and Virtual Assistants

In the era of digital banking, customer service needs to be immediate, intelligent, and available around the clock. ML-powered chatbots and virtual assistants fulfill this need by interpreting user queries, accessing backend databases, and providing contextual responses.

These bots are trained using natural language processing (NLP) and machine learning algorithms, allowing them to learn from past interactions and continuously improve. Over time, they can handle increasingly complex queries—from guiding users through account setup to helping them dispute unauthorized charges.

- Benefits: Reduction in operational costs, increased responsiveness, and scalable customer support.

- Example: Erica, the AI assistant from Bank of America, helps users track spending, make payments, and even offer financial advice.

- Relevance to AI and ML in Banking: Highlights how artificial intelligence complements machine learning to enhance customer experience.

5. Algorithmic and Predictive Trading

Algorithmic trading uses mathematical models and real-time data to make investment decisions without human intervention. Machine learning takes this further by enabling systems to learn from historical data and dynamically adapt strategies.

For instance, an ML system can analyze historical price trends, news sentiment, and even social media discussions to predict stock movements. High-frequency trading firms use reinforcement learning models to optimize trade execution, significantly increasing speed and profitability.

- Tools Used: Deep neural networks, Long Short-Term Memory (LSTM) models, reinforcement learning.

- Significance: Enables real-time decision-making and better handling of market volatility.

- AI vs Machine Learning: AI facilitates decision execution, while ML refines predictive accuracy.

6. Document and KYC Automation

KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are essential but traditionally time-consuming. ML-driven automation has revolutionized these processes by enabling optical character recognition (OCR), facial recognition, and biometric verification.

Machine learning models can scan documents, validate information, and cross-reference with national databases—all in seconds. Some systems also use natural language processing to extract relevant data from unstructured documents, such as PDFs or scanned forms.

- Machine Learning Trends: Image recognition, biometric scanning, and NLP adoption in onboarding processes.

- Example: A customer submits an ID document, which ML scans, validates, and cross-checks in under a minute.

- Machine Learning Challenges Addressed: Reduces manual errors and accelerates onboarding timelines.

7. Payment Processing Optimization

The growth of digital payments has brought a demand for more innovative and efficient processing systems. Machine learning payment processing models help banks manage transaction volumes intelligently by detecting patterns, forecasting load spikes, and suggesting system optimizations.

ML models also detect payment fraud, assess real-time risk, and improve transaction approval rates. Predictive analytics can help banks decide the best time to batch transactions or alert systems before a potential system overload occurs.

- Relevant Tool: Predictive maintenance models to ensure uninterrupted transaction processing.

- Impact: Reduced payment delays, improved user experience, and fewer failed transactions.

- Related Technology: Machine Learning Platforms used to deploy real-time predictive models.

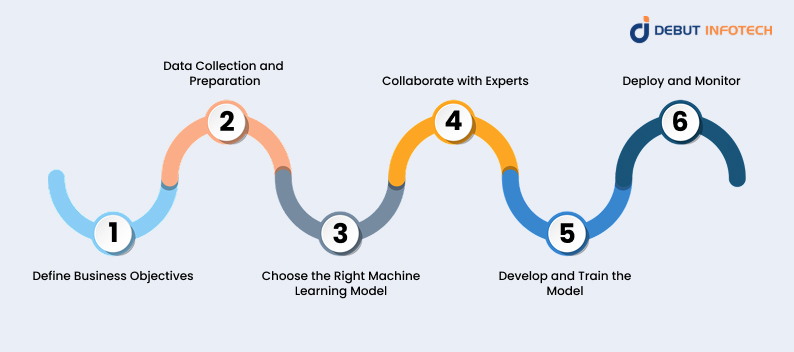

Execution: How to Implement Machine Learning in Banking

Implementing machine learning in banking isn’t just about deploying advanced algorithms—it’s about aligning technology with strategic goals, regulatory compliance, and operational efficiency. Below is a structured roadmap banks can follow to integrate ML into their systems and workflows successfully.

1. Define Business Objectives

Successful implementation begins with identifying specific business goals. Whether it’s improving fraud detection, enhancing customer insights, or automating compliance processes, clear objectives ensure that machine learning aligns with the banking strategy. This clarity also helps in selecting the right models and performance metrics down the line.

2. Data Collection and Preparation

Machine learning thrives on high-quality data. Banks must gather diverse datasets, including transactional history, customer profiles, credit scores, and even behavioral data from digital channels. However, legacy infrastructure and data silos often hinder effective data integration. To solve this, financial institutions increasingly rely on unified data lakes and ML-ready formats that support efficient data ingestion and processing. Proper data preprocessing—like normalization, feature selection, and outlier detection—is crucial before model training.

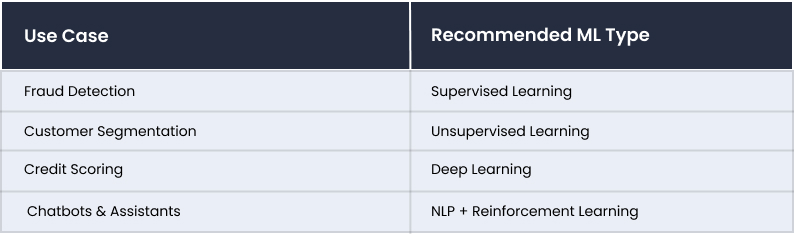

3. Choose the Right Machine Learning Model

Selecting the appropriate algorithm is key. Different banking tasks require different models, and understanding supervised vs unsupervised learning plays a vital role here. Here’s a breakdown:

Choosing the right Machine Learning Model also involves testing various machine learning techniques to determine which yields the most accurate and efficient results. Models like decision trees, neural networks, and support vector machines are often tested in parallel.

4. Collaborate with Experts

Not every bank has in-house AI talent. Engaging with machine learning consulting firms or machine learning development companies provides access to technical expertise, industry experience, and tried-and-true execution strategies. These firms help in use-case selection, solution architecture, model development, and compliance adherence.

5. Develop and Train the Model

Using platforms such as TensorFlow, Scikit-learn, or PyTorch, the development phase includes feature engineering, model training, cross-validation, and fine-tuning hyperparameters. For scalability and robustness, models must be trained using secure, compliant datasets while considering Machine learning challenges such as overfitting, class imbalance, and data leakage.

6. Deploy and Monitor

Once validated, the model is deployed into the bank’s operational environment using secure Machine learning platforms or cloud services like AWS, Azure ML, or GCP. Monitoring is essential to evaluate performance, detect drift, and trigger re-training. Automated monitoring systems can provide insights using deep learning in predictive analytics, ensuring consistent performance and compliance.

Additionally, integrating ML models with Machine Learning in business intelligence tools allows banks to make data-driven decisions across departments. As part of this execution strategy, real-time dashboards and alert systems can be established to help stakeholders respond proactively.

Overcoming Machine Learning Challenges in Banking

Data Privacy and Security

Data privacy and security are paramount in banking, especially when machine learning models handle sensitive customer data. To protect customer data, banks must comply with GDPR and PCI-DSS regulations. This involves using encryption and secure storage systems, as well as anonymizing data during machine learning processes, to prevent the exposure of personal information.

Regulatory Compliance

Machine learning models in banking must be explainable to comply with regulations. “Black-box” models, which are hard to interpret, raise concerns among regulators. To address this, financial institutions should prioritize explainable AI (XAI) solutions that allow regulators to understand decision-making processes. Additionally, maintaining audit trails and transparent documentation is essential to ensure compliance with both local and international laws.

Legacy System Integration

Many banks still rely on outdated systems, making it challenging to integrate machine learning tools. Legacy systems lack the infrastructure to support advanced AI algorithms. Integrating these systems with machine learning requires modular design and middleware solutions. This gradual integration approach helps ensure minimal disruption while upgrading to a more agile infrastructure.

Talent Gap

The demand for skilled machine learning professionals in banking is high, creating a talent gap. Banks often face challenges recruiting qualified experts in AI and machine learning. They frequently partner with an AI development or machine learning consulting firm to bridge this gap. Additionally, banks invest in upskilling their existing staff to ensure the effective implementation of machine-learning solutions.

Future of Machine Learning in Banking

The future of AI and ML in banking looks promising. Key machine learning trends to watch include:

- Adaptive AI: Systems that adapt to changes in customer behavior or market dynamics

- Federated Learning: A privacy-first approach to training ML models across decentralized data.

- Edge AI: Bringing ML computation closer to the data source, improving speed and privacy.

Emerging machine learning in business intelligence tools will empower banks to make smarter decisions faster, improving overall performance.

While AI and ML are often interchangeable, they are different.

- Artificial Intelligence (AI) refers to machines performing tasks that typically require human intelligence.

- Machine Learning (ML) is a subset of AI that trains models to learn from data.

Banks typically use both technologies together—AI powers decision-making interfaces like chatbots, while ML drives analytics engines behind the scenes.

Let’s Build Smarter Banking Solutions Together

Harness the full potential of machine learning in banking with tailored solutions that boost efficiency, security, and customer engagement.

Conclusion

Machine learning in the banking industry is no longer an emerging trend—it’s an essential component of modern financial operations. ML is changing how banks function at every level, from fraud detection to customer service automation. As machine learning development companies continue to innovate, the potential for transformation only grows.

At Debut Infotech, we provide machine learning development services that empower financial institutions to innovate, optimize, and scale securely. Whether you’re looking to implement machine learning for customer segmentation, automate KYC, or improve payment processing, our expert team can guide your journey. As the industry continues learning banking and finance through digital transformation, early adopters of machine learning will gain a decisive competitive edge.

Frequently Asked Questions

A. Machine learning is applied across multiple functions in the banking industry, including fraud detection, credit scoring, customer service automation, and algorithmic trading. By leveraging data-driven models, banks can enhance decision-making, reduce operational risks, and deliver more personalized service.

A. Machine learning payment processing improves efficiency by detecting anomalies, predicting system loads, and optimizing transaction flow. It helps banks prevent processing delays and fraud while enabling faster, more reliable customer service.

A. Machine learning for banking enhances credit scoring by analyzing various data points beyond traditional financial metrics, such as mobile phone usage, utility payments, and online behavior, leading to more accurate risk assessments and greater financial inclusion.

A. Machine learning challenges in banking include data privacy concerns, model interpretability, regulatory compliance, and the need for high-quality labeled data. Integrating ML systems into legacy banking infrastructure can also be technically complex and costly.

A. Supervised learning uses labeled data to train fraud detection and credit risk assessment models. On the other hand, unsupervised learning identifies patterns in unlabeled data and is often used for customer segmentation or anomaly detection in banking operations.

A. AI chatbots and virtual assistants in banking use natural language processing to handle routine tasks like account inquiries, fund transfers, and loan applications. They reduce customer service costs and improve user experience by offering instant, 24/7 support.

A. Machine learning consulting firms provide model development, deployment, and integration expertise tailored to financial services. They assist banks with strategy, compliance, and technical implementation, helping accelerate innovation while minimizing operational and regulatory risks.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment