Table of Contents

Home / Use Case /

Blockchain in Real Estate: Applications, Market Trends, and Practical Use Cases

The real estate industry has long been burdened by opaque transactions, fragmented record-keeping, high intermediary costs, and time-consuming processes. From property listing and title verification to leasing, investment, and asset transfer, nearly every touchpoint involves manual verification and institutional bottlenecks. Blockchain technology is emerging as a viable solution, promising greater transparency, automation, and trust in real estate transactions.

Blockchain provides a decentralized, immutable ledger that records ownership, transactions, and asset history with precision. In real estate, this means eliminating redundant paperwork, streamlining property transfers, and minimizing fraud through the use of tamper-proof records. One of the most practical use cases is the tokenization of real estate assets, where properties are digitized into tradable tokens. This fractional ownership model enables broader investor access, enhances liquidity, and allows for real-time trading on blockchain platforms.

Smart contracts automate rental agreements, escrow settlements, and compliance checks, reducing the need for intermediaries while ensuring legal enforceability. This accelerates processes like lease management and cross-border property deals. Title management is another high-impact area. Blockchain ensures clear, up-to-date ownership records, minimizing disputes and title insurance costs.

In commercial real estate, blockchain can simplify portfolio management, enable real-time audit trails, and enhance decision-making with transparent data flows. Property developers, REITs, and investment platforms are leveraging blockchain to attract global investors, ensure regulatory compliance, and cut operational overhead.

This article examines how blockchain is being applied across various real estate use cases, the benefits it offers stakeholders, and strategic paths to adoption in an increasingly digital-first property market.

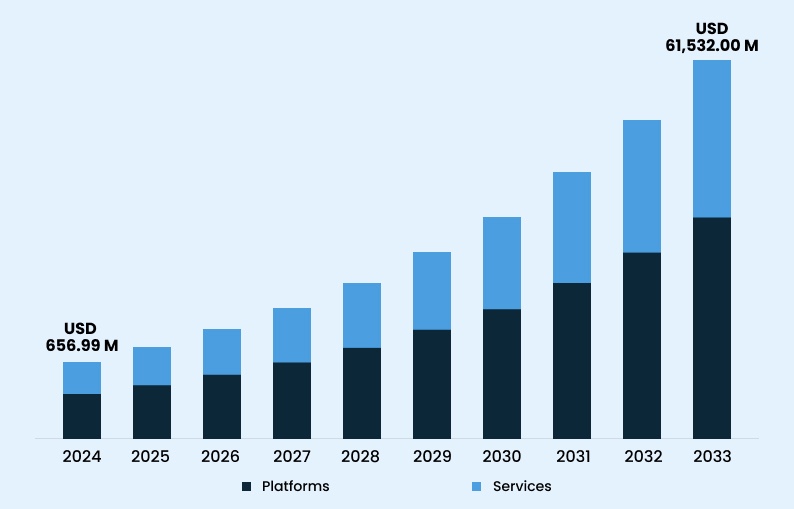

Blockchain in Real Estate: Key Statistics and Industry Insights

Blockchain in real estate is no longer a future concept—it’s reshaping how assets are bought, sold, financed, and managed. By removing intermediaries, automating transactions, and improving data transparency, blockchain applications in real estate are unlocking new levels of trust, efficiency, and liquidity across the industry.

From tokenizing properties and automating rental contracts to enabling transparent ownership records, blockchain is transforming traditional real estate workflows. The following statistics highlight the momentum this technology is gaining and the profound impact it’s expected to have across the sector.

According to Deloitte, blockchain in real estate can reduce property transaction time from months to just days by streamlining documentation and reducing dependency on intermediaries.

A study by PwC shows that real estate tokenization, one of the most impactful blockchain applications in real estate, could unlock $1.4 trillion in global illiquid asset value by enabling fractional ownership.

According to MarketsandMarkets, the blockchain in real estate market is expected to grow from $0.6 billion in 2021 to $3.9 billion by 2025, driven by increasing adoption for smart contracts, title management, and secure data exchange.

McKinsey estimates that blockchain applications in real estate can lead to cost savings of up to 20% in property management by automating lease agreements, reducing fraud, and improving audit trails.

These insights reflect the growing confidence in blockchain’s ability to redefine real estate operations, making transactions faster, more secure, and accessible to a broader class of investors and stakeholders.

Understanding the Role of Blockchain in Real Estate

Blockchain in Real Estate refers to the use of distributed ledger technology to improve key aspects of the real estate ecosystem. It facilitates secure, transparent, and tamper-proof transactions while reducing the reliance on intermediaries. Key blockchain applications in real estate include tokenization, smart contracts, property record management, and secure cross-border transactions.

By digitizing and decentralizing property-related data, blockchain enhances transaction speed, trust, and efficiency. It simplifies ownership transfer, ensures data integrity, and lowers transaction costs.

Key Applications:

- Tokenization of assets enables fractional property ownership, making real estate investments more accessible and liquid.

- Smart contracts automate lease agreements, escrows, and transactions, reducing manual processing and legal overhead.

- Immutable title management ensures accurate, fraud-resistant ownership records and speeds up verification.

- Streamlined cross-border transactions improve transparency and reduce delays in international property deals.

- Automated compliance and audits reduce human error and simplify due diligence.

- Decentralized property listings offer verified, tamper-resistant information for buyers, sellers, and brokers.

- Real-time data sharing improves coordination between stakeholders like banks, notaries, regulators, and agents.

- Reduced administrative workload by replacing paperwork with secure, digital processes.

- Enhanced investor access via blockchain-powered platforms supporting regulated, tokenized property offerings.

Blockchain’s integration into real estate is reshaping how properties are bought, sold, leased, and invested in, creating a more open, secure, and data-driven market environment.

Modernize Property Management with Smart Contracts

Automate lease agreements, rent collection, and compliance with blockchain-backed solutions. Ready to simplify operations and reduce manual overhead?

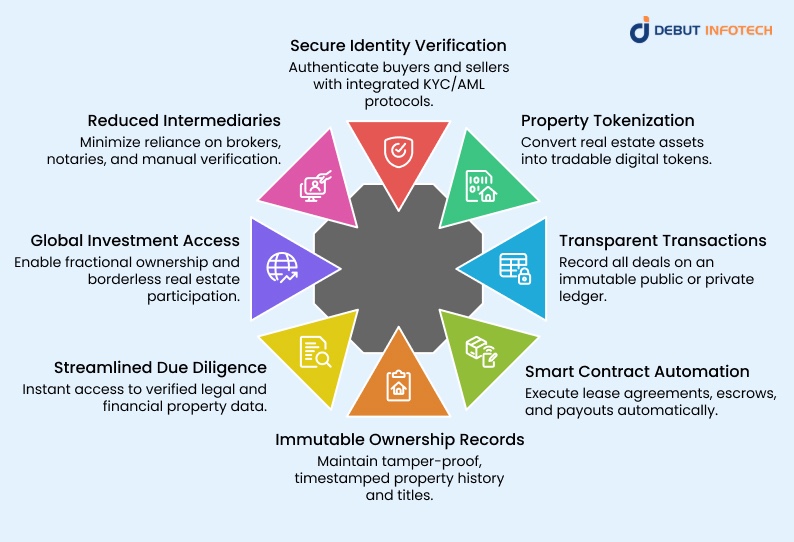

Solving Real Estate Challenges with Blockchain: Advancing Trust, Transparency, and Efficiency

The real estate sector faces long-standing challenges—delays in transactions, fraud risk, lack of transparency, and limited investor access. The application of blockchain in real estate offers practical, forward-looking solutions to address these issues while reshaping how properties are bought, sold, and managed. We’re committed to building blockchain-powered systems that are not only efficient but also secure, scalable, and compliant with modern regulations.

Streamlining Property Transactions

Property transactions involve multiple intermediaries, lengthy paperwork, and manual verification, which can delay closing. With smart contracts—a key blockchain use case in real estate—we automate agreements, ownership transfers, and escrow processes. These contracts self-execute once conditions are met, reducing delays, lowering costs, and minimizing human error.

Enhancing Title Verification and Ownership Clarity

Title fraud and disputes over ownership history create risk and legal complexity. We develop blockchain-based title management systems that ensure a tamper-proof, immutable record of property ownership. These systems eliminate the need for redundant verification, reduce title insurance costs, and offer instant access to accurate property histories.

Expanding Access through Asset Tokenization

Tokenization allows real estate assets to be divided into digital tokens representing fractional ownership. This application of blockchain in real estate opens up investment opportunities to a wider pool of investors and adds liquidity to an otherwise illiquid market. We enable regulatory-compliant tokenization platforms that support trading, dividend payouts, and transparent cap table management.

Improving Cross-Border Investments

Foreign real estate investment is often slowed by regulatory hurdles and currency issues. Our blockchain-powered platforms support international property transactions with real-time KYC/AML verification, secure stablecoin payments, and transparent documentation, making cross-border investing faster, safer, and more efficient.

Securing Real Estate Data

Real estate data, including property valuations, leases, legal documents, and tax records, is typically scattered across databases and vulnerable to manipulation. Our blockchain systems integrate real estate data into a secure, shared ledger with controlled access. Every change is timestamped, audited, and verified, ensuring data integrity and reducing fraud risk.

Ensuring Compliance and Auditability

Blockchain in real estate introduces real-time audit trails, reducing compliance costs and enabling easier reporting. We build systems that are compatible with local regulations and offer granular permissioning, allowing stakeholders to monitor transactions and regulatory adherence with complete transparency.

Addressing Industry Skepticism

Despite its benefits, some real estate stakeholders are hesitant to adopt blockchain due to perceived complexity and legal uncertainty. We address these concerns by designing intuitive user interfaces, offering regulatory consultation, and providing training for agents, investors, and developers, facilitating smoother adoption and stakeholder confidence.

Enabling Scalable Infrastructure

Real estate projects vary from single-property listings to institutional-grade portfolios. Our blockchain solutions are cloud-ready, modular, and capable of scaling as asset volumes, users, and transaction frequency grow. Whether tokenizing a single building or managing hundreds of properties, our infrastructure adapts without compromising speed or security.

Ethical and Legal Alignment

As with any transformative technology, the ethical and legal dimensions of blockchain use must be considered. Our development processes follow best practices for responsible innovation, ensuring transparency, user consent, and fairness. We also comply with global standards for real estate tokenization, digital securities, and cross-border data sharing.

How Does Blockchain Work in Real Estate?

Implementing blockchain in real estate involves multiple components working together to digitize and secure property data, streamline transactions, and increase transparency across the entire real estate lifecycle. By integrating blockchain into real estate systems, property owners, investors, agents, and regulators can experience faster, tamper-proof transactions and better data visibility, transforming how real estate is bought, sold, financed, and managed.

1. Property Data Collection

Real estate projects begin with gathering data such as property titles, ownership records, zoning details, valuation reports, lease agreements, and regulatory documents. This data is essential for verifying property status and enabling blockchain-based digitization.

2. Smart Contract Development

Smart contracts are self-executing code that run on blockchain networks. For real estate, they automate lease terms, escrow release, property transfers, and investor distributions. Our blockchain development services include smart contract creation tailored for real estate applications.

3. Asset Tokenization

One of the core blockchain use cases in real estate is tokenization—converting property rights into digital tokens. This allows for fractional ownership and increased liquidity. Tokens are issued via standards like ERC-3643 and are stored securely on decentralized networks.

4. On-Chain Property Registry

Instead of relying on paper-based records or siloed databases, property details are registered on-chain. Blockchain’s immutability ensures these records can’t be tampered with, reducing fraud and speeding up title verification processes.

5. Investor KYC/AML Onboarding

Before allowing token purchases, platforms integrate Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This ensures that only verified users can participate, aligning with jurisdictional compliance. These workflows are often powered through blockchain-integrated identity tools.

6. Decentralized Marketplace Integration

Tokenized properties are listed on decentralized marketplaces, where investors can trade property-backed tokens. These platforms run on blockchain infrastructure and support cross-border investments with full traceability.

7. Payment and Settlement

Blockchain enables instant, traceable payments using cryptocurrencies or stablecoins. Settlements that traditionally took weeks are now completed in minutes through smart contracts and decentralized finance (DeFi) protocols.

8. Governance and Voting

In larger real estate tokenization projects (e.g., commercial properties or REITs), governance can be enabled via blockchain. Token holders may vote on property decisions (like renovations or resale), with results recorded transparently on-chain.

9. Compliance Automation

Jurisdictional compliance—including tax rules, investment caps, and ownership restrictions—is coded directly into smart contracts. This eliminates manual intervention and ensures regulatory compliance in real-time.

10. Reporting and Auditing

Every transaction on the blockchain leaves a cryptographic trail. This simplifies audit processes, as stakeholders and regulators can access transparent, real-time data, boosting trust across the value chain.

11. Feedback and System Evolution

User interactions and regulatory updates inform the future development of blockchain platforms. Feedback loops help improve smart contract logic, enhance user experience, and adapt to emerging blockchain applications in real estate.

Streamline Escrow with Blockchain Automation

Reduce legal fees and delays with smart contract-based escrow services. Want faster settlements and improved buyer-seller trust?

What Are the Multiple Use Cases of Blockchain in Real Estate?

Blockchain simplifies traditionally complex real estate processes, delivering greater transparency, efficiency, and security across transactions. Our team builds blockchain-based solutions designed to automate, verify, and secure property dealings, ranging from asset tokenization to cross-border ownership transfers.

From streamlining property title management to enabling fractional investments through tokenization, blockchain brings trust and traceability to every step. Our systems follow rigorous compliance protocols and include robust security measures such as encryption, role-based access, and audit-ready records.

Explore how blockchain in real estate can reduce fraud, cut costs, and simplify operations—while creating a secure, transparent environment for investors, developers, agents, and buyers alike.

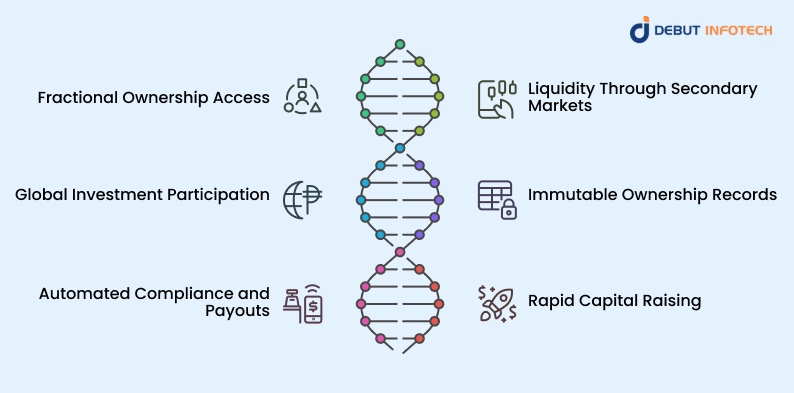

Property Tokenization

Property tokenization is transforming how people invest in real estate. It involves converting the value of a physical property into blockchain-based digital tokens, where each token represents fractional ownership. These tokens are stored, traded, and managed on a secure blockchain network, opening up the real estate market to a wider pool of global investors.

By enabling fractional ownership, tokenization reduces the capital barrier traditionally associated with real estate. Investors can purchase tokens of a property in small denominations, unlocking liquidity in an otherwise illiquid asset class. Tokens can be traded on secondary markets, providing both exit opportunities and portfolio flexibility.

Blockchain ensures transparency, as every transaction is recorded on an immutable ledger. It significantly reduces the risk of fraud, enhances trust, and provides 24/7 traceability for all parties. Embedded smart contracts handle dividend distribution, compliance checks, and investor eligibility, minimizing operational burden for platforms.

- Fractional Ownership Access

Real estate tokenization allows properties to be divided into fractional digital shares, enabling small-scale investors to participate in high-value real estate deals that were previously inaccessible. - Liquidity Through Secondary Markets

Unlike traditional real estate, tokenized assets can be traded on blockchain-powered secondary marketplaces. This enhances liquidity and gives investors a convenient exit strategy. - Global Investment Participation

Tokenized platforms eliminate geographical boundaries. Investors from any part of the world can buy property tokens with minimal regulatory friction using compliant smart contracts. - Immutable Ownership Records

Blockchain ensures a tamper-proof record of all token transactions and ownership history, boosting transparency and trust in property dealings. - Automated Compliance and Payouts

Embedded rules within smart contracts handle KYC/AML checks, enforce ownership caps, and automate rent/dividend distribution to token holders, reducing manual intervention. - Rapid Capital Raising

Real estate developers and asset managers can raise funds by issuing tokens faster than traditional financing methods, backed by regulatory-compliant infrastructure.

Smart Contracts for Lease Agreements

Smart contracts automate lease agreements by executing pre-defined conditions without intermediaries. These digital contracts live on a blockchain and trigger actions—like rent payment, renewal, or eviction notices—once agreed-upon terms are met. This use case drastically improves efficiency, transparency, and trust between tenants, landlords, and property managers.

Traditional leasing involves manual paperwork, third-party legal verification, and recurring administrative overhead. Blockchain in real estate transactions simplifies this through code-based automation. Lease agreements stored on-chain are tamper-resistant, reducing the risk of fraud or data loss. For commercial real estate, where leases are complex and long-term, smart contracts provide programmable logic for escalations, penalty calculations, and service obligations.

Additionally, smart contracts can integrate digital identity verification, tenant scoring, and rental history—all accessible via APIs or plugins. This accelerates onboarding and reduces disputes.

- Immutable Ownership Trails

All property transfers are permanently recorded on the blockchain, preventing double ownership claims and title manipulation. - Reduced Title Verification Costs

Title insurance, document certification, and legal verification costs are significantly reduced by eliminating intermediaries. - Instant Access to Title Records

Property history, tax liens, and encumbrances can be accessed instantly by banks, buyers, and legal advisors through a blockchain interface. - Cross-Jurisdictional Support

Blockchain in real estate transactions enables international investors to verify property records across borders without relying on local authorities. - Government Adoption & Trust Building

Countries like Georgia and Sweden have already piloted blockchain land registries, proving the model’s scalability and public-sector efficiency. - Integration with Real Estate Apps

Using real estate app development services, title records can be linked directly to listings, improving buyer confidence and simplifying closing processes.

Title Management and Ownership Records

One of the most trusted blockchain applications in real estate is digitizing and securing property titles. Traditional title management systems are fragmented, manual, and often lead to disputes over ownership, duplication, or fraud. By recording title data on a blockchain ledger, each ownership change is timestamped and stored immutably, creating a verifiable history of the property from the moment it was first recorded.

Blockchain-based title management reduces dependency on intermediaries such as lawyers, brokers, and public offices. This significantly speeds up verification processes, minimizes human error, and lowers the overall cost of title insurance and due diligence. It also offers a permanent audit trail, enabling seamless collaboration between banks, government authorities, and international stakeholders.

For governments and enterprise blockchain development companies, implementing blockchain-based registries means a major leap forward in transparency, operational efficiency, and fraud prevention. It also supports land reforms, especially in emerging markets where unclear ownership and corruption undermine trust.

- Immutable Ownership Trails

Every change in ownership is permanently recorded on the blockchain, making property transfers secure, transparent, and auditable. - Reduced Processing Time

Blockchain eliminates redundant paperwork and third-party verification, drastically reducing the time taken to verify and transfer property titles. - Regulatory Trust and Legal Validity

Blockchain title systems provide legally admissible, tamper-proof proof of ownership—valuable for property litigation, estate planning, or inheritance processes. - Cross-Border Clarity

International buyers can access transparent and verifiable property histories, making this a valuable application of blockchain in real estate for global asset deals.

Cross-Border Real Estate Transactions

Cross-border real estate transactions are traditionally slowed by banking delays, multiple currencies, legal red tape, and jurisdictional differences. Blockchain in real estate transactions solves these issues by enabling fast, verifiable, and secure exchanges using digital assets, smart contracts, and decentralized identities.

Stablecoin payments, for instance, allow international buyers to transfer funds in minutes rather than days, bypassing the high fees and exchange rate uncertainty associated with traditional wire transfers. Smart contracts automate and enforce transaction terms, including deposits, compliance checks, and closing conditions—streamlining everything from offer to final payment.

This approach is particularly valuable in blockchain in commercial real estate, where high-value deals demand both security and speed. Real estate platforms built by blockchain real estate companies are integrating these capabilities to open their markets to international investors without compromising regulatory requirements.

- Instant Crypto Payments via Stablecoins

Buyers can use digital currencies to settle property transactions, eliminating delays caused by bank transfers and currency exchange. - Automated Compliance via Smart Contracts

Jurisdiction-specific regulations like KYC, AML, and foreign investment limits are coded into smart contracts, enabling legally compliant transactions. - Global Reach for Developers and Sellers

Real estate firms can open their portfolios to foreign buyers via blockchain-powered platforms built by blockchain app development partners. - Audit-Ready Transaction Trails

Every transaction and update is timestamped, enabling seamless audits and regulatory reporting across regions. - Multi-Language, Multi-Currency Integration

With built-in multi-currency and multilingual interfaces, real estate platforms offer a frictionless experience for international buyers. - Secure Digital Identity Management

Buyers and sellers are verified using decentralized identity protocols (DIDs), enhancing trust and reducing fraud in blockchain in real estate transactions.

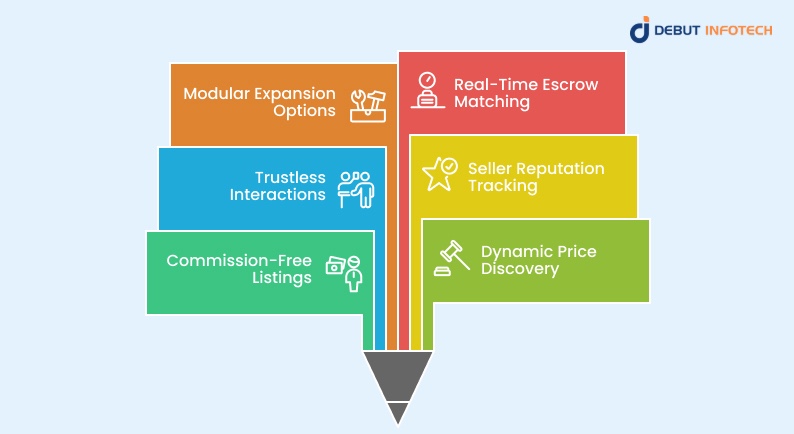

Decentralized Real Estate Marketplaces

Decentralized real estate marketplaces represent a new paradigm in property exchange. Instead of relying on centralized listing services or brokers, buyers and sellers can engage directly via blockchain platforms. This application of blockchain in real estate enhances transparency, reduces costs, and enables round-the-clock property trading without geographical constraints.

Each listing is anchored to verified on-chain data such as legal status, title records, prior valuations, and ownership history. Smart contracts automate offer submissions, payments, and transfer of rights, building user trust through verifiable logic and eliminating disputes. With regulatory-aligned development, these marketplaces support both retail and institutional users globally.

- Commission-Free Listings

Property owners can bypass broker fees by listing directly on decentralized platforms, boosting profit margins. - Dynamic Price Discovery

Blockchain-enabled bidding and negotiation features allow for real-time price adjustments and fair market valuation. - Trustless Interactions

Transactions are executed automatically once conditions are met, with no reliance on intermediaries to validate deal terms. - Seller Reputation Tracking

On-chain transaction histories build seller profiles over time, giving buyers confidence in who they’re transacting with. - Modular Expansion Options

Marketplaces can be tailored for specific verticals like vacation homes, distressed assets, or REO listings, using enterprise blockchain development company support. - Real-Time Escrow Matching

Buyers can initiate smart escrow contracts instantly upon offer acceptance, speeding up closings without waiting for third-party intervention.

Build a Decentralized Real Estate Marketplace

Launch peer-to-peer platforms without intermediaries using blockchain infrastructure. Want to offer transparent listings and real-time transactions?

Escrow Automation

Escrow accounts are traditionally used to protect funds during high-value transactions, including property purchases. However, they often involve slow processing, manual document verification, and high third-party fees. Blockchain brings automation and precision to this space by allowing programmable escrow contracts that execute based on verified milestones.

These smart escrow solutions are ideal for transactions involving multiple stakeholders—buyers, sellers, agents, and legal teams—especially in blockchain in commercial real estate, where transaction values and contractual complexity are high. Once key conditions like title clearance or inspection approvals are validated, smart contracts release funds automatically.

- Milestone-Based Fund Control

Parties can define multiple release conditions tied to legal clearances, inspections, or loan disbursements—automating what would normally require human validation. - Dual-Signature and Arbitration Logic

Escrow smart contracts can include dual-approval mechanisms or even trigger dispute resolution workflows if both parties raise flags. - Escrow as a Service (EaaS)

Real estate startups can offer escrow functionality as a standalone feature or API integration, expanding into fintech-aligned services. - Multi-Asset Payment Support

Escrows can hold and release payments in stablecoins, native tokens, or fiat-backed digital assets, offering flexibility in international deals. - Integrated Due Diligence Modules

Smart escrow contracts can be paired with oracles to confirm external data—like regulatory approvals or appraisal values—before releasing funds. - Usage in Private Deal Rooms

Private REITs, investor syndicates, or high-net-worth clients can use custom escrow flows built by blockchain app development experts to facilitate complex negotiations.

Blockchain-Based REITs (Real Estate Investment Trusts)

Blockchain-based REITs represent a modern evolution of real estate investing by enabling shares of real estate portfolios to be tokenized and distributed via blockchain platforms. Traditionally, REITs have been limited to institutional investors or heavily regulated public markets. With tokenization, retail investors can now gain exposure to income-generating real estate through fractional digital assets, improving market access and liquidity.

This application of blockchain in real estate ensures transparent performance tracking, instant ownership verification, and automated dividend payouts. Using smart contracts and investor dashboards, real estate firms can manage capital flows efficiently while ensuring regulatory compliance across borders.

- Fractional Investment Access

Tokenized REITs allow investors to buy small portions of real estate portfolios, making high-value commercial assets accessible to everyday investors. - On-Chain Portfolio Performance Metrics

Occupancy rates, income distributions, NAV updates, and expense ratios are all recorded on-chain, enabling real-time investor insights. - Automated Payout Distribution

Smart contracts execute scheduled dividend payments, reducing reliance on fund administrators and ensuring on-time returns. - Global Investor Enablement

Through KYC-integrated onboarding, real estate blockchain companies can offer REIT participation to international investors without violating jurisdictional rules. - Secondary Market Trading

Tokenized REIT shares can be listed on compliant exchanges, enhancing liquidity and enabling quick rebalancing of investor portfolios. - Scalable Fund Operations

By partnering with an enterprise blockchain development company, REITs can manage multi-property portfolios, investor classes, and compliance workflows under one secure digital ecosystem.

Land Registry Digitization

Land registry systems have long been plagued by inefficiencies, outdated documentation, and corruption. Blockchain is now being used by governments and municipalities to digitize land records, offering a secure, immutable solution for ownership verification, history tracking, and public record access.

This blockchain in real estate use case replaces paper-based records with tamper-proof digital entries on a distributed ledger. Every transaction, from land allocation to mortgage assignment, is permanently stored and timestamped, ensuring full transparency. Public–private partnerships are emerging worldwide, as governments collaborate with custom blockchain application development teams to implement pilot programs and national platforms.

- Tamper-Proof Recordkeeping

Ownership records, encumbrances, and historical transfers are stored on an immutable blockchain ledger, eliminating the risk of forgery or double claims. - Dispute Reduction and Legal Clarity

Transparent recordkeeping reduces land conflicts, legal disputes, and unauthorized sales, especially in rural or under-documented regions. - Self-Service Ownership Verification

Citizens and banks can verify land records via web portals or mobile apps, reducing dependency on government offices and middlemen. - Government Transparency and Accountability

Blockchain ensures that land allocations and sales are publicly visible, discouraging favoritism, land grabs, or undocumented transfers. - Digitized Transfer Workflows

Smart contract-enabled title transfers can automate ownership changes when preconditions (e.g., tax clearance) are met, shortening weeks-long processes to minutes. - National and Regional Scalability

Governments can adopt modular land registry systems built by blockchain app development firms that scale from local jurisdictions to entire countries.

Construction Project Management

Managing construction projects requires coordination across contractors, suppliers, equipment, and inspection teams. Delays and disputes often arise from poor communication, lack of real-time updates, and unclear responsibilities. Blockchain introduces a transparent and tamper-proof system for tracking every action across the project lifecycle—from procurement to completion.

By using blockchain to record tasks, approvals, and deliveries, all stakeholders gain access to a single source of truth. Smart contracts automate payments tied to verified progress, and material sourcing records can be tracked from origin to site, ensuring accountability and sustainability.

- Milestone-Triggered Payments

Payments are automatically released when construction milestones are validated, reducing delays and conflicts over due amounts. - Transparent Scope Changes

Any changes to project scope, cost, or design are logged transparently, preventing miscommunication and unauthorized modifications. - Traceable Material Sourcing

Materials are logged from the supplier to the site, enabling verification of quality, origin, and environmental standards. - Dispute Prevention

All agreements and approvals are stored immutably, reducing claims, delays, and legal interventions. - Enhanced Site Monitoring

Integrated sensors and data logs allow real-time recording of environmental and operational conditions on the blockchain. - Cross-Team Visibility

Project owners, contractors, and regulators can view real-time progress and documentation, improving accountability across the board.

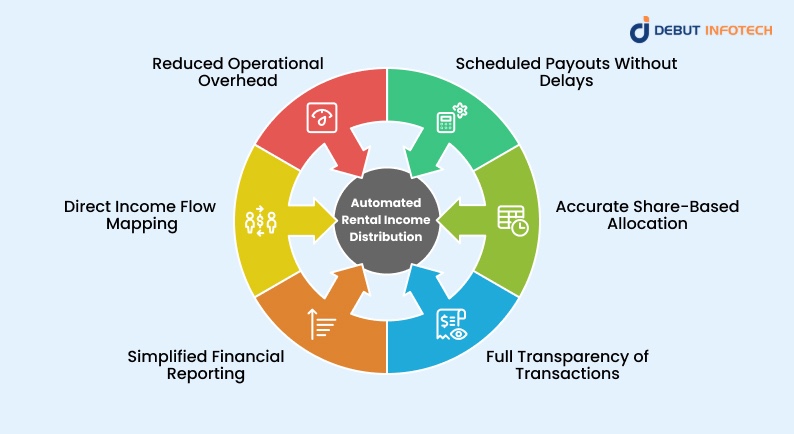

Automated Rental Income Distribution

Distributing rental income to multiple investors or stakeholders can be a complex and time-consuming task. Blockchain simplifies this process by automating the calculation and distribution of earnings based on ownership shares, improving accuracy and transparency.

With automated systems, rental income is disbursed at predefined intervals without human oversight. Each transaction is logged for auditing purposes, and investors can track earnings in real-time, creating a seamless income experience.

- Scheduled Payouts Without Delays

Income is distributed automatically on a monthly, weekly, or custom basis, ensuring consistent returns to all recipients. - Accurate Share-Based Allocation

Distributions are calculated precisely based on each party’s ownership, even as stakes fluctuate. - Full Transparency of Transactions

Every payout is permanently recorded and viewable, building trust among investors and stakeholders. - Simplified Financial Reporting

Automatically generated logs of income and distributions make end-of-year reporting and audits straightforward. - Direct Income Flow Mapping

Rental income from tenants is linked directly to the investor ledger, ensuring traceability and financial clarity. - Reduced Operational Overhead

Automation removes the need for manual tracking, calculations, and payouts, reducing errors and administrative burden.

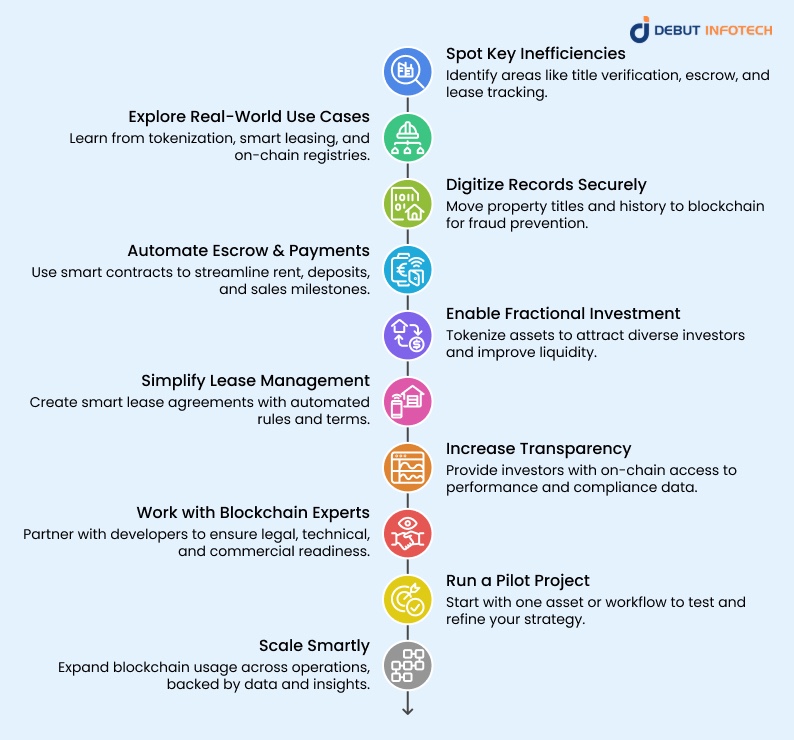

How Can You Start Using Blockchain in Real Estate?

Blockchain is reshaping how real estate transactions are conducted, assets are managed, and ownership is verified. From digitizing property titles to enabling fractional investment, blockchain technology offers scalable, secure solutions that reduce friction, improve trust, and enhance operational efficiency. Here’s how to begin your blockchain journey in real estate:

1. Identify High-Value Use Cases

Start by pinpointing inefficiencies in your workflows, such as title verification delays, escrow dependency, or lack of transparency in leasing. These are ideal areas where blockchain can deliver measurable improvements in speed, accuracy, and stakeholder confidence.

2. Understand Industry Applications

Explore how blockchain is being applied in property tokenization, land registry digitization, smart leasing, and rental income automation. Learning from real-world use cases helps define practical goals and sets a clear path for tailored adoption.

3. Secure Property Records On-Chain

Digitize title deeds and ownership records using blockchain to create a tamper-proof ledger. This enhances trust, reduces fraud, and speeds up due diligence during transactions, especially useful for cross-border deals or complex property histories.

4. Automate Escrow and Payments

Use smart contracts to automate escrow conditions, rent payments, and milestone-based transfers. This removes reliance on intermediaries, reduces delays, and cuts legal and administrative overheads while ensuring compliance.

5. Enable Fractional Ownership

Tokenize real estate assets to allow fractional investment. This expands access to a broader investor base, increases liquidity, and unlocks new revenue streams by allowing property shares to be traded digitally and securely.

6. Improve Lease Management

Deploy smart contracts to manage lease agreements with built-in rules for rent, penalties, renewals, and terminations. These self-executing contracts reduce human error and streamline interactions between landlords and tenants.

7. Build Transparency for Investors

Use blockchain to give investors real-time access to financials, occupancy data, and maintenance logs. Transparent, on-chain data builds credibility and makes investor relations more efficient and trustworthy.

8. Collaborate with Blockchain Experts

Work with specialists who understand the legal, technical, and commercial sides of blockchain in real estate. The right development team can help you build secure, compliant platforms tailored to your unique needs.

9. Launch a Pilot Initiative

Start small—focus on a specific area like automating rent collection, tokenizing a single asset, or digitizing title records. Measure outcomes, gather feedback, and use the pilot as proof of value before expanding further.

10. Scale and Evolve Strategically

As you gain confidence, expand your blockchain initiatives across more assets or operations. Keep optimizing based on user data and market feedback. Stay informed about regulatory updates and tech advancements to maintain long-term relevance and ROI.

How Can Debut Infotech Scale Your Real Estate Business with Advanced Blockchain Solutions?

As the real estate sector embraces digital transformation, blockchain technology is proving to be a game-changer. From improving transactional transparency to enabling global property investment, blockchain offers scalable solutions that modernize operations and enhance trust. Debut Infotech helps real estate businesses adopt tailored blockchain solutions to unlock new revenue streams, streamline processes, and stay ahead in a competitive market.

1. Faster Property Transactions

Blockchain eliminates manual verification steps and third-party delays by recording every step of a property deal on an immutable ledger. This significantly reduces closing times and administrative overhead across residential and commercial transactions.

2. Fractional Ownership Access

Tokenizing properties allows businesses to split real estate assets into digital tokens, enabling partial ownership. This approach lowers investment barriers and increases liquidity by attracting small to mid-sized global investors.

3. Automated Lease Management

Smart contracts streamline rental workflows by auto-executing lease terms, rent collection, renewals, and penalties. This reduces dependency on manual oversight and improves trust between tenants and property managers.

4. Cross-Border Deal Enablement

Blockchain platforms simplify international real estate investments by handling KYC, stablecoin payments, and legal compliance. This allows real estate firms to target and serve global investors with minimal friction.

5. Secure Title Records

Land title histories are stored on-chain, eliminating the risk of forgery, duplication, or disputes. This strengthens property rights and accelerates due diligence for buyers, lenders, and real estate developers.

6. Decentralized Marketplaces

Blockchain supports peer-to-peer property platforms where users can list, verify, and transact without intermediaries. This reduces listing costs, improves data transparency, and builds trust among participants in digital property ecosystems.

7. Automated Rent Payouts

With blockchain, rent income can be distributed to property investors automatically based on ownership stakes. These transactions are logged in real time, ensuring clarity, consistency, and minimal manual reconciliation.

8. Transparent REIT Operations

Tokenized REIT platforms allow investors to track returns, occupancy rates, and fund performance in real time. This level of on-chain visibility builds investor confidence and eases global fund participation.

9. Construction Monitoring

Blockchain tracks material sourcing, contractor tasks, and supplier deliveries throughout construction phases. Combined with IoT sensors, it offers real-time oversight and ensures accountability for all project stakeholders.

10. Long-Term Innovation Partner

Debut Infotech works as a dedicated blockchain development partner, assisting in strategy, pilot launches, compliance, and platform scaling. Our solutions evolve with your business and regulatory landscape.

Conclusion

As the real estate industry undergoes rapid transformation, integrating blockchain technology into core operations is no longer optional—it’s essential. From enhancing property transparency to accelerating transactions and enabling fractional ownership, blockchain offers practical solutions to many of the inefficiencies plaguing the traditional real estate ecosystem.

At Debut Infotech, we’re helping real estate enterprises unlock the full potential of blockchain. Whether it’s digitizing land records, automating rent distribution, streamlining lease agreements through smart contracts, or launching tokenized investment platforms, our solutions are designed to modernize operations while ensuring security, compliance, and scalability.

Our expertise in blockchain app development, smart contract integration, and regulatory-aligned architecture ensures that clients not only meet today’s demands but are also prepared for tomorrow’s opportunities. With a focus on performance, reliability, and usability, we build blockchain systems that enable real estate businesses to operate with greater agility and trust.

By staying at the forefront of blockchain innovation and aligning with industry best practices, Debut Infotech empowers real estate companies to grow, scale, and lead in an increasingly digital market. Whether your goal is to attract global investors, reduce operational overhead, or increase transaction transparency, our blockchain-driven approach offers a strategic path to long-term growth and resilience in the real estate sector.

FAQs

A. Blockchain in real estate enables real-time tracking of assets, lease records, and ownership transfers on a secure, tamper-proof ledger. It simplifies data auditing and eliminates duplicate entries across departments, ensuring consistent asset visibility across geographies. This is critical for property managers handling diverse, large-scale portfolios.

A. Blockchain minimizes reliance on intermediaries by automating title verification, rent settlements, and compliance workflows. It reduces legal fees, paperwork processing costs, and delays caused by third-party validations, enabling firms to lower overhead and allocate resources toward higher-value operations.

A. Blockchain uses cryptographic hashes and distributed consensus to secure property data. Each transaction is verified and stored across multiple nodes, making it nearly impossible to tamper with. This reduces fraud, enhances data integrity, and protects sensitive ownership history from unauthorized access.

A. Yes. Smart contracts automate enforcement of terms, ensuring on-time payments, scheduled rent increases, and automatic penalty triggers. This minimizes disputes and manual oversight.

Smart contract advantages include:

. Automated rent escalation

. Penalty enforcement

. On-time renewal alerts

. Reduced legal intervention

A. Tokenization enables fractional investment in high-value assets, allowing institutions to diversify without full ownership. This approach improves liquidity, reduces entry barriers, and accelerates capital deployment while offering transparent ownership records and secondary trading opportunities for dynamic portfolio management.

A. To integrate blockchain into existing real estate systems, enterprises require an adaptable and secure infrastructure that aligns with current platforms and workflows. This includes blockchain middleware, data interoperability layers, and smart contract functionality.

Key integration components:

. Smart contract layer

. Secure APIs to ERP/CRM

. Permissioned blockchain network

. Identity and access management

. Data encryption protocols

. Scalable cloud or hybrid infrastructure for data storage and syncing

A. Blockchain allows asset owners to tokenize properties, enabling fractional sale and resale on secondary markets. This reduces traditional illiquidity and opens participation to a broader pool of accredited investors, ultimately enhancing capital mobility in large-scale commercial real estate transactions.

A. Real estate tokenization requires strict adherence to securities laws, which vary by region. Enterprises must embed KYC/AML protocols, investor accreditation checks, and ongoing compliance reporting within smart contracts. This ensures tokens remain legally valid and secure for investors, making regulatory transparency a core requirement of blockchain applications in real estate tokenization workflows.

A. Yes. Blockchain enables frictionless cross-border transactions by allowing instant settlements via stablecoins or cryptocurrencies. Smart contracts enforce country-specific KYC/AML checks and automate tax or disclosure requirements. This enhances auditability, fosters trust, and supports legal compliance, making blockchain in real estate a powerful tool for compliant international investment and sustainable global deal execution.

A. Enterprises can create custom blockchain solutions by partnering with experienced developers who specialize in smart contracts, compliance, and decentralized infrastructure. A modular approach enables seamless integration into existing systems, while enhancing transparency and automation.

Key capabilities include:

. On-chain title management

. Smart contract-driven rent flows

. Secondary market integration

. Secure document verification

. Cross-platform property tokenization dashboards

Talk With Our Expert

Our Related Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Talk With Our Expert

15+ years in IT

to deliver value that lasts

Over 500 success stories

including Disney, KFC, DocuSign & HDFC Bank

Team of 150 specialists

Web, mobile, Blockchain, AI & ML

Presence across 5 continents

Get Dedicated Account Managers operating in your time-zone.