Table of Contents

Home / Blog / Cryptocurrency

Crypto Licensing in the U.S. : Navigating Regulations & Compliance

July 31, 2025

July 31, 2025

Obtaining a crypto license USA is a critical step for any digital asset business looking to operate legally and scale nationwide. The U.S. remains the largest cryptocurrency market globally, with over 65 million Americans owning crypto, according to research.

To ensure compliance, U.S. businesses must register as a Money Services Business (MSB) with FinCEN and, in many cases, obtain Money Transmitter Licenses (MTLs) at the state level. Meanwhile, a 2023 report by Chainalysis showed that the U.S. ranked first in global crypto transaction volume, signaling both high adoption and tighter oversight.

For crypto exchanges, wallet providers, and fintech startups, the right license offers legal clarity, regulatory protection, and increased investor confidence. This guide outlines the advantages, process, tax requirements, and penalties tied to U.S. crypto licensing.

Don’t Just Wait—Dominate the U.S. Crypto Game

The longer you wait, the more competition gets ahead. Let’s help you lock down your U.S. crypto license, step by step.

Origin and Overview of Crypto License in the USA

The emergence of cryptocurrency in the United States prompted a gradual yet structured approach to regulation. Initially, digital assets existed in a grey zone, but with increasing adoption and market capitalization, state and federal authorities began implementing specific licensing frameworks.

The cornerstone of U.S. crypto regulation includes Money Services Business (MSB) registration under FinCEN and Money Transmitter Licenses (MTLs) issued by individual states. These frameworks ensure compliance, security, and transparency within the industry. A U.S. crypto license not only signifies regulatory alignment but also enables a company to operate legally across one or more jurisdictions, depending on the type and scope of authorization obtained.

Advantages of a Crypto License in the USA

Securing a cryptocurrency license in the United States offers significant strategic, legal, and commercial benefits. Here are the key advantages that make U.S. licensing highly attractive to crypto entrepreneurs and institutions.

1. Access to the Largest Financial Market

Holding a crypto license in the U.S. provides unparalleled access to the world’s largest financial ecosystem. The United States is home to some of the most active retail and institutional investors globally. With regulatory backing, crypto businesses can directly integrate with a market that accounts for over 20% of global financial flows—offering long-term scalability and credibility.

2. Trust of Institutional Investors

Institutional trust isn’t handed out—it’s earned through compliance and transparency. U.S. licensing assures hedge funds, asset managers, and fintech giants that a crypto exchange or service provider meets strict operational standards. If you’re planning to court institutional capital, having a U.S. crypto license is non-negotiable.

3. Market Leadership and Innovation

Many of the innovations shaping Web3 and decentralized finance (DeFi) originate in the U.S., thanks to its robust entrepreneurial environment and access to venture capital. A licensed presence places you within this innovation hub, allowing you to pilot new technologies with the legitimacy required for global scaling.

4. Nationwide Operations (with all required licenses)

In the U.S., crypto licensing is fragmented at the state level. With the appropriate licenses—most notably the MTL and MSB—a crypto company can expand across state lines. Each state license opens a new regional market, while federal compliance ensures overarching legal protection. This layered access model supports steady, scalable growth.

5. Regulatory Clarity and Legal Protection

Operating without a clear regulatory umbrella can leave your business vulnerable to lawsuits, shutdowns, and sudden cease-and-desist orders. A U.S. crypto license offers legal clarity. It protects you from regulatory overreach and gives your users peace of mind, knowing you’re compliant and credible.

6. Access to Financial Services and Partnerships

Securing a license unlocks relationships with banks, payment processors, and insurance providers that are otherwise off-limits to unregulated players. For crypto businesses, that means smoother fiat on-ramps, secure storage solutions, and better institutional partnerships—essentials for long-term success.

Regulated Cryptocurrency Activities Covered by a U.S. Crypto License

The scope of activities regulated under a U.S. crypto license depends on the specific framework—state or federal. Broadly, it covers:

- Fiat-to-crypto and crypto-to-fiat exchanges

- Crypto wallet custodianship

- Stablecoin issuance

- Cryptocurrency ATMs

- Cross-border remittances using digital assets

- DeFi platforms offering custody or interest-bearing services

- Broker-dealer operations involving digital assets

- Tokenized securities platforms

At the federal level, the Financial Crimes Enforcement Network (FinCEN) governs anti-money laundering (AML) and know-your-customer (KYC) compliance through MSB registration. At the state level, businesses must apply for MTLs in every state where they wish to operate, unless they are exempt. Notably, some activities—like issuing securities tokens—may also fall under SEC jurisdiction, depending on how the asset is classified.

Main Regulatory Frameworks for a Crypto License in the USA

Crypto regulation in the U.S. is structured under several key legal frameworks. Understanding these frameworks is essential before applying for a license, as each governs different aspects of digital asset operations.

1. MSB (Money Services Business)

FinCEN requires that any entity involved in money transmission register as an MSB. This includes crypto exchanges, wallet providers, and some ICO projects. MSB registration is federal-level and primarily targets AML and counter-terrorism financing compliance. It mandates robust customer identification, record-keeping, and suspicious activity reporting systems.

2. MTL (Money Transmitter License)

This is where things get complex. The MTL is state-specific and must be obtained in every jurisdiction where your business serves customers. Each state has its own set of requirements, fees, and review timelines. If you want to operate nationwide, you’ll need MTLs in all 50 states—or partner with an entity that already has them.

3. Other Regimes

Besides FinCEN and state regulators, crypto businesses may also fall under the oversight of the SEC (for security tokens), the CFTC (for crypto derivatives), or the IRS (for tax reporting). Future frameworks—such as a federal BitLicense—may consolidate these regulatory tracks, offering a more unified path to compliance.

Features of Obtaining a Cryptocurrency License in the USA

In the U.S., crypto licenses are granted at both the federal and state levels. Federal licensing supports financial security and AML efforts, while state rules focus more on consumer protection and applicant credibility.

License type depends on your business model. Crypto-to-fiat transactions need a Money Transmitter License (MTL). At the same time, crypto-to-crypto exchanges often require a Money Services Business (MSB) license.

The MTL cryptocurrency license in the USA applies to financial entities that:

- Offer money transfer services domestically or internationally.

- Deal in foreign currency exchange operations.

- Handle postal or wire transfers.

- Exchange currencies when amounts exceed $1,000.

- Issue and sell traveler’s checks or similar financial instruments.

Many startups pair licensing with tailored cryptocurrency development services to streamline wallet integration, transaction modules, and compliance automation.

Each state has unique requirements. To operate in multiple states, you must obtain licenses in each. New York mandates a BitLicense, while Illinois exempts digital-only entities. A single state license may be sufficient for non-U.S. operations that require a U.S. bank account.

Requirements for Licensing in the USA

To obtain a crypto license USA, companies must meet both federal and state-level regulatory requirements. Applicants must:

- Register with the U.S. Department of the Treasury.

- Implement anti-money laundering and counter-terrorism policies.

- Report suspicious activity to federal authorities.

- Submit transaction reports exceeding $10,000

- Retain detailed financial transaction records.

- Keep exchange-related accounting documentation.

- Comply with official fund transfer procedures.

In addition, most states require firms to prove strong financial stability. Budget thresholds differ by jurisdiction—for instance, $250,000 in California and up to $500,000 in New York. Without meeting these benchmarks, approval of the license is unlikely.

These regulations especially apply to firms offering crypto wallet development services or exchange platforms tied to fiat currency.

Related Read: Best Crypto Wallet Companies

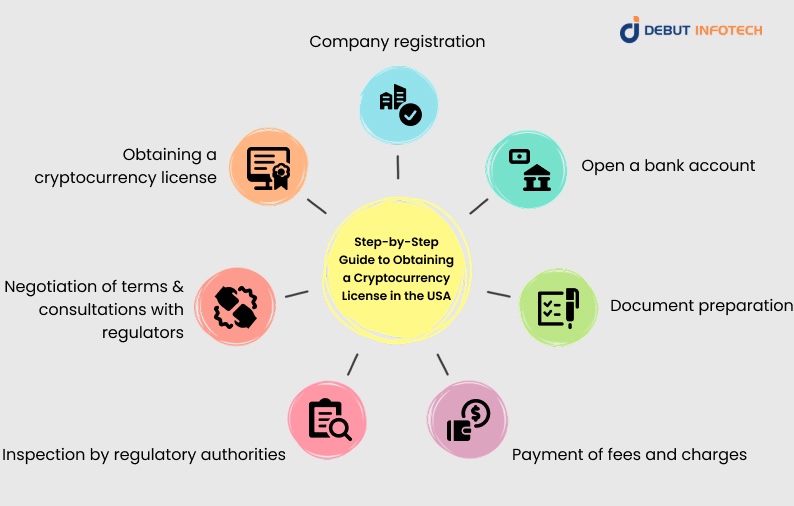

Step-by-Step Guide to Obtaining a Cryptocurrency License in the USA

If you’re planning to launch a crypto venture in the U.S., here’s what your roadmap looks like:

1. Company registration

You must first establish a legal business entity in the U.S., typically a corporation or LLC. Choose a crypto-friendly state, such as Delaware or Wyoming. Prepare your articles of incorporation, appoint directors, and file with the state’s Secretary of State before moving to compliance preparation.

2. Open a bank account

A U.S.-based corporate bank account is mandatory for separating business funds and ensuring financial transparency. Select a crypto-friendly bank that is familiar with MSB and MTL requirements. Expect enhanced due diligence, including the submission of your business plan, compliance policies, and officer background documentation, before approval.

3. Document preparation

Compile a comprehensive compliance package, including Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, transaction monitoring frameworks, internal controls, a financial model, and employee training plans. These documents demonstrate your company’s readiness to operate in accordance with the regulatory guidelines established by both federal and state agencies.

4. Payment of fees and charges

Prepare for both federal and state-level licensing fees. These may include application charges, annual renewal costs, legal counsel, background check processing, and surety bonds. Depending on your business model and the regions of operation, total upfront costs can range from $50,000 to $200,000 or more.

5. Inspection by regulatory authorities

Regulatory authorities may conduct in-depth reviews or interviews with your compliance team. They often assess your platform’s technical security, data privacy measures, and transaction monitoring tools. Expect requests for live platform demonstrations or access to proprietary systems as part of their operational due diligence.

6. Negotiation of terms and consultations with regulators

You may need to adjust your internal controls, financial disclosures, or customer onboarding practices to comply with regulatory requirements. This back-and-forth ensures your policies meet evolving expectations. Legal experts or top crypto companies often assist during this phase to align your business model with applicable regulatory interpretations and precedents.

7. Obtaining a cryptocurrency license

After satisfying all documentation, interviews, and legal requirements, you will be issued your MSB registration or individual MTLs. These licenses authorize your company to operate within approved jurisdictions, provided you continue to meet reporting deadlines, audit obligations, and ongoing compliance requirements throughout the licensing period.

Consequences of Violating FinCEN Rules

Non-compliance with FinCEN rules can result in severe legal and reputational consequences. The following are some of the most common and severe outcomes companies may face for regulatory violations or negligence:

1. Administrative fines

Failure to register as an MSB or maintain proper AML compliance can result in substantial penalties. FinCEN has issued fines ranging from $100,000 to over $10 million, depending on the severity, frequency, and duration of the violations. These fines can cripple operations and stall investor interest.

2. License revocation

Non-compliance or repeated infractions can result in the suspension or complete revocation of your cryptocurrency license. This means you must immediately cease operations, notify customers, and may face litigation. Reapplying becomes more difficult as future regulators and partner institutions become aware of your record.

3. Reputational damage

A FinCEN enforcement action—especially one publicized in national media—can permanently damage your firm’s reputation. Clients may pull funds, banks could close accounts, and future licensing attempts may face skepticism. In a trust-driven industry, reputation is often more valuable than any product feature.

4. Additional scrutiny

Regulatory violations put your company under ongoing watch. Expect more frequent audits, surprise inspections, and stricter monitoring conditions. In many cases, FinCEN may require external compliance monitors or annual independent reviews, which can drive up costs and increase the administrative burden on your compliance team.

Taxation of Crypto Companies in the USA

Tax regulation for cryptocurrency businesses in the U.S. falls under the authority of the Internal Revenue Service (IRS). In 2014, the IRS officially classified cryptocurrency as property, establishing that all transactions related to cryptocurrency must be subject to taxation under existing tax codes.

Based on current legislation:

- Employee wages paid in crypto must be taxed as income.

- Digital currency payments within contractual agreements are also taxable.

- All crypto-related payments must be reported to federal agencies, with profits converted and declared in U.S. dollars.

A significant update came in 2017 when new legislation required every crypto transaction to be taxed at the moment it occurs. This eliminated tax-free crypto swaps and increased reporting responsibilities for individuals and companies alike.

Tax Rates

Crypto businesses operating in the U.S. are subject to multiple layers of taxation. It’s essential to understand the key tax categories that apply to your profits and services to remain compliant and avoid penalties.

1. Profit Tax

Crypto companies in the U.S. are subject to corporate income tax on net profits. The federal rate is 21%, and state-level corporate taxes vary, ranging from 0% (e.g., Wyoming) to over 11% (e.g., New Jersey).

2. Sales Tax

Sales tax generally applies to digital goods or services rendered in some states. However, the treatment of crypto itself as a taxable “product” remains inconsistent. Businesses must determine state-specific rules and apply tax accordingly.

Timeline for Obtaining a Cryptocurrency License in the USA

The overall licensing process can take anywhere from 4 to 18 months. MSB registration is relatively quick—around 2 to 4 weeks—but securing MTLs in multiple states is far more time-intensive. Some state reviews can stretch to 9–12 months due to background checks, business model vetting, and compliance manual evaluations. A proactive legal strategy can shorten the timeline.

Cost of Obtaining a Cryptocurrency License in the USA

The cost of licensing a crypto business in the U.S. depends on various operational and jurisdictional factors.

Here’s how different elements can influence your total compliance and setup expenses.

1. State of registration

The cost structure significantly varies by state. For example, New York’s BitLicense is complex and expensive, with application fees over $5,000 and extensive legal costs. States like Wyoming or North Carolina offer streamlined processes with lower fees, but still require comprehensive compliance documentation and surety bonds.

2. Exact list of future services

If your business involves custody, derivatives, or stablecoin issuance, expect higher costs due to increased regulatory scrutiny and security standards. Each additional service may require specific legal consultations, additional insurance, or compliance infrastructure, pushing costs higher compared to basic exchange or white label crypto wallet operations.

3. Region of operation for the future crypto company

Operating in multiple states requires separate Money Transmitter Licenses, each carrying its own fees, bonding requirements, and renewal charges. Applying in 10–15 states may push initial licensing and compliance costs beyond $300,000, especially when considering legal, audit, and professional advisory expenses.

From Chaos to Compliance—We Handle the License Maze

Our experts handle the paperwork, legal filings, and state-specific rules so you can focus on launching your crypto business.

Conclusion

Navigating the cryptocurrency licensing landscape in the USA requires strategic planning, regulatory understanding, and operational transparency. From legal protections and nationwide access to market credibility, licensing opens essential doors for any serious crypto business. However, the process also demands meticulous compliance to avoid steep penalties and reputational damage.

With the right guidance, framework, and partnership with a reputable crypto development company, businesses can position themselves for sustainable growth and secure institutional alliances. Whether you’re expanding or just starting, U.S. licensing provides a robust foundation for long-term success in the digital asset industry.

FAQs

A. You’ll need to register as a Money Services Business (MSB) with FinCEN, then apply for state-specific licenses—usually a Money Transmitter License (MTL). Each state has its own rules, so expect to deal with paperwork, undergo background checks, develop compliance plans, and invest a substantial amount of startup capital.

A. Yeah, the SEC regulates crypto—if they decide a token counts as a security. That’s the tricky part. They don’t regulate all crypto, just the ones they believe fit the legal definition of a security under U.S. law. It remains a legal gray area in many respects.

A. The SEC uses the “Howey Test” to determine whether a crypto asset constitutes a security. If it appears to be an investment where profits depend on someone else’s work, it’s likely under their supervision. That means stricter rules—like registration and disclosures—for any crypto that fits that mold.

A. Costs vary by state, but you’re usually looking at $30,000 to $100,000+ for the full process. That includes application fees, legal help, surety bonds, and compliance costs. States like New York (with its BitLicense) are on the higher end. It’s not a cheap or quick process.

A. Most state licenses expire annually and require renewal. But you’ve got to stay compliant year-round—file reports, pay fees, keep records in check. If you fail to comply, the license can be suspended or revoked before the year’s up.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment