Table of Contents

Home / Blog / Cryptocurrency

OTC Crypto Exchange Development Cost: Complete Breakdown for 2025

August 5, 2025

August 5, 2025

The OTC crypto exchange development cost depends on several key elements, including feature complexity, regulatory demands, and your chosen development approach.

As the demand for private, high-volume trading increases, OTC exchanges are becoming a strategic investment. According to Grand View Research, the global cryptocurrency market was valued at $5.70 billion in 2024 and is projected to more than double, reaching $11.71 billion by 2030, with a CAGR of 13.1% from 2025 to 2030.

Supporting this trend, Finery Markets analyzed four million spot trades and reported a 106% year-on-year growth in OTC volume during 2024. This firmly establishes OTC as a third major liquidity pillar, alongside centralized and decentralized exchanges.

Suppose you’re planning to build an OTC Crypto Exchange platform from scratch or are opting for a white-label solution. In that case, it’s crucial to understand the cost structure. In this guide, we will explain how OTC exchanges work, outline their benefits, detail the associated cost factors, discuss pricing models, and provide strategies to minimize costs.

Plan Your Project with Transparent and Affordable Pricing

You don’t have to spend a fortune to build a great platform. Our pricing models are clear, flexible, and built around your priorities.

What is an OTC Crypto Exchange?

An OTC (Over-the-Counter) crypto exchange is a trading platform where large volumes of cryptocurrencies are bought and sold directly between two parties—without relying on public order books. These trades typically involve high-net-worth individuals, institutions, or hedge funds looking to avoid price slippage and maintain confidentiality.

In contrast to traditional crypto exchanges, OTC platforms facilitate negotiated, high-value transactions in a more discreet and personalized manner. The primary objective is to establish a controlled trading environment where buyers and sellers can conduct transactions securely and efficiently, without affecting market prices.

How Does an OTC Crypto Exchange Work?

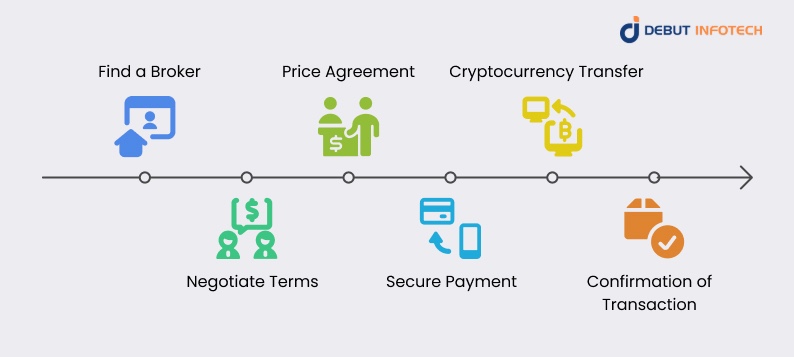

OTC crypto exchanges streamline private cryptocurrency transactions by removing the intermediaries you’d find in regular exchanges. Here’s how the process generally unfolds:

1. Find a Broker

Start by identifying a reputable OTC desk or broker with a solid track record. This broker acts as the intermediary, helping to connect buyers and sellers of large crypto volumes. They often provide escrow services, compliance checks, and ensure that both parties are verified before any transaction begins, offering a secure trading environment.

2. Negotiate Terms

Once a connection is established, both parties discuss and finalize key trade details, including asset type, transaction size, preferred settlement method, and timelines. Brokers help mediate these terms, ensuring fair and secure agreements are reached. Legal contracts may also be signed to protect both sides, especially for high-value deals or institutional trades.

3. Price Agreement

After reviewing current market conditions and historical data, both buyer and seller reach a mutually acceptable price. This agreed-upon rate often reflects the benefits of bulk trading and is locked in to prevent losses driven by volatility. Brokers ensure that neither party manipulates the deal and confirm that the terms remain consistent throughout the process until execution.

4. Secure Payment

Funds are transferred through secure banking channels or crypto wallets, depending on the agreed settlement method. OTC desks often utilize escrow services to temporarily hold funds until both parties fulfill their obligations. This step protects against fraud and confirms that the buyer has the necessary funds before assets are transferred.

5. Cryptocurrency Transfer

Once the payment is verified, the seller releases the cryptocurrency—either directly to the buyer’s wallet or via a secure blockchain transaction, which is monitored by the OTC desk. This part of the process is executed quickly to prevent price changes and minimize the risk of transaction failures, ensuring smooth delivery.

6. Confirmation of Transaction

Both parties confirm that the agreed-upon assets and funds have been received in full. The broker or platform typically generates a confirmation report, and receipts may be recorded for compliance or auditing purposes. This final step completes the transaction, often within hours, and the trade is officially closed.

Benefits of OTC Crypto Exchange Development

Launching your own OTC crypto exchange offers several advantages. Here’s what makes it a smart move:

1. High Liquidity

OTC platforms are designed to support high-volume trades without depending on public order books. This ensures that institutional traders and crypto whales can buy or sell large amounts instantly. The platform connects them directly with other large-volume parties, offering seamless execution that would otherwise disrupt traditional exchange prices.

2. Privacy & Security

Unlike public exchanges, OTC platforms offer discreet environments for private transactions. Personal data and transaction details are not exposed to the public, thereby reducing the risk of front-running and targeted attacks.

Security measures, such as two-factor authentication, multi-signature wallets, and encrypted communication, further protect both user identity and funds.

3. Revenue Opportunities

Platform owners can implement a variety of revenue streams—such as transaction commissions, premium memberships, or brokerage fees. Custom services, such as fiat settlement assistance or risk consulting, can also be monetized. As demand grows among institutional clients, OTC exchanges become lucrative businesses with recurring income potential and long-term growth prospects.

4. Customizable Solutions

OTC exchange development allows businesses to create platforms tailored to their audience. Whether you’re targeting hedge funds, private investors, or crypto firms, the interface, features, compliance modules, and even branding can be designed accordingly. This ensures a distinct user experience aligned with your market niche and operational goals.

5. Faster Settlements

With fewer intermediaries and private channels, OTC exchanges offer faster transaction times compared to traditional platforms. Once the deal is agreed upon, the payment and crypto transfer happen in a streamlined manner, often within hours. This speed enhances efficiency, improves user satisfaction, and gives institutional clients an edge.

6. No Price Slippage

Price slippage happens when large orders disrupt market prices on public exchanges. OTC platforms eliminate this by negotiating fixed prices between parties ahead of the trade. This ensures pricing transparency and consistency, ensuring that neither party is disadvantaged by volatility during the execution of large-volume transactions.

What is the Cost to Develop an OTC Crypto Exchange?

OTC crypto exchange development cost varies widely based on technical complexity, design expectations, and regional factors. A basic platform might range between $40,000 and $80,000, while a more robust, enterprise-grade platform with extensive customization could exceed $200,000. The final OTC crypto exchange price depends not just on development hours, but also on post-launch support, licensing, and integrations. An accurate estimate requires assessing the platform’s required functionalities, regulatory adherence, user interface standards, and backend infrastructure.

Factors Affecting OTC Crypto Exchange Development Cost

Several elements influence how much you’ll spend building an OTC crypto exchange. These include:

1. Location or Region

The geographical location where development takes place can significantly affect your costs. Developers or crypto exchange development companies in North America or Western Europe typically charge higher rates than those in Southeast Asia or Eastern Europe. Additionally, the legal and regulatory landscape of your chosen jurisdiction also adds to costs, including licensing, tax, and ongoing compliance fees.

Estimated Cost Impact:

- North America/Western Europe: $100–$200/hour

- Eastern Europe/Southeast Asia: $40–$80/hour

- Regional legal consultation and licensing: $10,000 – $50,000

2. Development Team Experience

Highly experienced blockchain developers, especially those with prior experience in cryptocurrency exchange architecture and financial compliance, command premium rates. While they increase upfront costs, they also reduce long-term risks and potential rework. A seasoned team delivers scalable, secure, and regulation-ready solutions, which are essential for handling large OTC transactions reliably.

Estimated Cost Impact:

- Basic team: $30,000 – $50,000

- Experienced team (blockchain + security): $80,000 – $150,000

- CTO/Project manager fees (if outsourced): $5,000 – $20,000/month

3. App Complexity

The more advanced the exchange—such as those that include real-time chat, API integration, customizable dashboards, and smart contract support—the more expensive it becomes. Basic platforms are faster to build and cost less, but high-functionality apps require longer development timelines, intensive coding, and robust testing to meet user and regulatory expectations.

Estimated Cost Impact:

- Basic app: $40,000 – $70,000

- Mid-level app: $80,000 – $120,000

- Complex enterprise app: $150,000 – $250,000+

4. Functionalities and Features

Incorporating features such as escrow integration, user verification (KYC), real-time analytics, and fiat-to-crypto conversion increases the workload and associated costs. Each feature requires backend integration, frontend customization, and rigorous security testing. The more features you add upfront, the higher the development time, QA cycles, and total project budget will be.

Estimated Cost Impact:

- KYC/AML, wallet, escrow, notifications: $10,000 – $25,000

- Custom modules (analytics, broker dashboard): $10,000 – $30,000

5. Safety Procedures

OTC platforms handle high-value trades, so comprehensive safety protocols are critical. Multi-layer security, penetration testing, code audits, and regular vulnerability checks are necessary but expensive. However, skimping on security can expose your platform to attacks or fraud—leading to greater losses than the initial investment in protective systems.

Estimated Cost Impact:

- Smart contract audit: $5,000 – $20,000

- Penetration testing: $3,000 – $15,000

- Security architecture: $10,000 – $25,000

6. Regulatory Compliance

Meeting local and international crypto regulations requires integrating KYC/AML tools, reporting systems, and legal oversight. These processes often require the services of third-party providers or in-house compliance teams. Navigating this landscape can be time-consuming and costly, particularly in regions with complex or rapidly evolving cryptocurrency laws and financial reporting requirements.

Estimated Cost Impact:

- Initial legal setup: $15,000 – $50,000

- Ongoing compliance tools/licenses: $5,000 – $15,000/year

7. Insurance Cost

To build user trust and manage risk, many platforms take out cybersecurity insurance. These policies help protect against asset loss, data breaches, and downtime. While they don’t directly affect development time, acquiring proper coverage is an operational cost that must be factored into your total investment budget.

Estimated Cost Impact:

- Platform liability/cybersecurity insurance: $5,000 – $30,000/year

- Premiums may increase depending on volume and jurisdiction.

8. User Experience and Design

A seamless and intuitive user interface is essential for retaining high-value clients. Custom UI/UX design, cross-platform responsiveness, and user testing all contribute to development costs. Platforms targeting institutional clients must maintain a high standard of visual and functional quality, which adds layers of iteration and refinement to the development process.

Estimated Cost Impact:

- Standard design (responsive, clean UI): $5,000 – $10,000

- Custom UX (prototypes, animations, testing): $15,000 – $30,000

9. Integration of Blockchain

The blockchain protocol chosen—whether Ethereum, Binance Smart Chain, or Solana—has an impact on the overall cost. Each chain has its own unique tools, documentation, and performance considerations. Integrating multiple chains increases technical complexity and development time, especially when optimizing for transaction speed, network fees, and smart contract compatibility.

Estimated Cost Impact:

- Single chain (e.g., Ethereum): $5,000 – $15,000

- Multi-chain integration: $15,000 – $30,000+

10. Payment Gateway Integration

Supporting fiat and crypto payments securely requires banking partnerships or APIs from trusted gateways. These integrations need to be compliant, encrypted, and user-friendly. Depending on the provider, transaction volumes, and legal requirements, the cost for payment processing can be substantial and may include licensing or usage fees.

Estimated Cost Impact:

- Crypto gateway (e.g., Coinbase Commerce): $3,000 – $10,000

- Fiat payment gateway (bank API, Stripe): $5,000 – $15,000

- Regulatory approval for fiat services may incur additional fees.

11. Maintenance and Support

Post-launch technical support, bug fixes, server upgrades, and software updates are ongoing expenses. A quality Bitcoin exchange must stay operational 24/7 with minimal downtime. Maintenance contracts or in-house teams will require consistent budgeting to ensure that the system runs smoothly and remains compatible with emerging industry standards.

Estimated Cost Impact:

- Monthly maintenance (basic): $1,000 – $3,000/month

- Full technical support and updates: $5,000 – $10,000/month

12. Promotions and Marketing

Once built, your OTC exchange will require a robust marketing strategy, including SEO, content creation, paid advertising, and PR campaigns. These costs vary depending on target markets and competition, but can be as high as development expenses. A visible, trusted platform is essential to attract and retain large-volume clients.

Estimated Cost Impact:

- Initial branding and content: $5,000 – $10,000

- Monthly SEO, PPC, and social media: $3,000 – $15,000/month

- Public relations & influencer campaigns: $10,000 – $30,000

Cost Breakdown by Development Method

Depending on your approach, the development route you choose affects the OTC crypto exchange development cost:

1. Custom Solution

Developing a custom-built OTC crypto exchange means starting from scratch, which provides full control over architecture, design, and security. These solutions are tailored to your brand and audience, support high scalability, and offer advanced integrations, such as AI risk engines or proprietary liquidity modules.

However, they require heavy investment—often between $100,000 and $250,000—and 6–12 months of development time. You’ll also need dedicated DevOps, legal, UI/UX, and QA teams, making this approach ideal for large enterprises or funded startups seeking unique positioning and long-term scalability.

2. White Label Solutions

White label crypto exchange platforms offer pre-built, ready-to-deploy codebases that can be customized with your branding and core features. These solutions typically include built-in KYC/AML, wallet management, and liquidity modules.

Costs range from $40,000 to $70,000, depending on the vendor and level of customization. Development time is significantly shorter—often 4–8 weeks. This route is suitable for companies aiming for quicker market entry while retaining room for future feature expansion. However, scalability and feature flexibility may be limited compared to fully custom platforms.

3. Clone Software Solution

Clone solutions replicate the functionality of existing OTC exchanges like Kraken or Binance OTC. These offer the fastest and most budget-friendly entry into the market, typically costing $25,000 to $45,000. While development time is usually just 2–4 weeks, you may encounter limitations in unique branding, future updates, and scalability. They’re ideal for MVPs, pilot launches, or companies with tight budgets. However, clone software may lack strong compliance frameworks and require security enhancements before handling large-volume institutional clients.

Ways to Reduce OTC Crypto Exchange Development Cost

Cost efficiency is crucial—especially in a competitive space. Here are practical strategies to keep the cost to build OTC crypto exchange under control:

1. Leverage White-Label Solutions

White-label platforms offer a pre-coded backend and customizable frontend, reducing the need for building from the ground up. This significantly lowers development costs and accelerates time to market. You can still tailor user experience and branding while relying on tried-and-tested architecture to avoid technical risks and budget overruns.

2. Prioritize Core Features

Launching with only essential functionalities, such as trade execution, KYC, secure wallets, and transaction tracking, helps minimize both time and cost. Advanced features, such as AI bots or real-time reporting, can be introduced gradually. This phased development keeps your initial budget focused on critical components that support a live launch.

3. Optimize Development Team Structure

A hybrid approach—utilizing in-house leads and offshore developers—helps reduce costs without compromising quality. Assign core modules, such as architecture and compliance, to experienced staff, while frontend or auxiliary tasks can be outsourced. This blended model strikes a balance between expertise and affordability, while reducing the need for full-time staff across all layers.

4. Partner with Liquidity Providers

Integrating with a reliable third-party liquidity provider eliminates the need to build a complex matching engine or maintain reserve balances. This partnership ensures smoother operations, helps meet high-volume client expectations, and reduces backend workload. It’s an efficient way to add market depth without inflating your development cost.

5. Use Open-Source Technologies

Open-source frameworks for wallet management, blockchain integration, and KYC can significantly cut licensing and build costs. These tools are often well-maintained, peer-reviewed, and secure—making them ideal for foundational layers. However, always assess the quality, update frequency, and security history of the open-source libraries you integrate.

Got a Budget? Let’s Build Around It

We’ll show you what kind of OTC crypto exchange fits within your range—feature by feature.

Conclusion

Understanding the OTC crypto exchange development cost is vital for anyone planning to build a secure, scalable platform tailored to high-volume traders. From legal compliance and blockchain integration to UX and security, each factor shapes your budget.

Fortunately, with the right development method and cost-saving strategies, you can launch efficiently without compromising on quality. Whether you’re a startup or scaling enterprise, smart budgeting ensures your OTC exchange remains competitive and future-ready in a rapidly expanding crypto market.

FAQs

A. It typically ranges from $50,000 to over $500,000. It all depends on what features you want, how secure it needs to be, and if you’re going custom or using white-label software. Think of it like building a house—basic or luxury makes a big difference.

A. It’s a mix of frontend (what users see), backend (the engine), database, trading engine, wallet system, admin panel, and APIs. Security layers are also built in. All these parts communicate with each other to handle trades, funds, logins, and everything in between—fast and securely.

A. Yes, you can—but it’s not a weekend project. You’ll need licenses (depending on your location), strong technical expertise, banking partners, robust security measures, and a way to acquire users. If you have the budget, legal backing, and a solid development team, you’re good to go.

A. Roughly 3 to 6 months if you’re starting from scratch. Using a white-label solution may reduce that to 4–8 weeks. However, add time for testing, compliance checks, and adjustments. Faster isn’t always better—security and performance need time to get right.

A. Mostly through trading fees—every time someone buys or sells, the exchange takes a cut. Some also earn from withdrawal fees, listing fees for tokens, spreads on OTC trades, or premium features. The more volume you push through the platform, the more money it makes.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment