Table of Contents

Home / Blog / Tokenization

Understanding Private Equity and the Tokenization Process

July 18, 2025

July 18, 2025

As technology advances, so does finance. New technologies are reshaping asset management, trading, and access modalities. The other most transformative development, in the tokenization of private equity, marries traditional investment vehicles with blockchain-related innovations. Investors and businesses must understand this metamorphosis, as with it comes new avenues for liquidity, transparency, and wider participation within the private market.

Private equity, which typically involves investing in privately held companies, has long been considered a lucrative yet exclusive asset class, accessible only to institutional investors and high-net-worth individuals. However, the rise of blockchain and digital asset infrastructure enables private equity tokenization, making this once-opaque market more accessible, efficient, and liquid. This article dives deep into the process of tokenizing private equity, explores its benefits, challenges, and applications, and examines how emerging tokenization platforms are transforming the investment landscape.

Looking to Tokenize Your Private Equity Offering?

Tokenizing private equity can unlock liquidity, reduce administrative friction, and expand your investor reach. At Debut Infotech, we specialize in building secure, regulatory-compliant tokenization platforms tailored to your asset structure and business goals.

What is Private Equity?

Private equity (PE) refers to capital investments made in companies that are not listed on public exchanges. These investments mainly include equity investments in the shares of start-ups, growing companies, or distressed companies to improve their performance, with an eventual exit through selling, merging, or listing at a profit.

A private equity firm raises money through limited partnerships and then manages the money to buy, restructure, or grow companies. Investors participate by committing their money for a long period (often 7-10 years), during which the fund managers maximize the asset’s value.

While the private equity sector was considered a “closed” space with large institutional players dominating its flows, pressures are now emerging for it to be more agile, inclusive, and technology-enabled, thus sparking interest in tokenization as a contemporary solution.

What is Tokenization?

Tokenization is the process of converting ownership rights in an asset into a digital token that lives on a blockchain. These tokens represent a share of ownership in real-world or digital assets and can be traded or transferred between parties securely, transparently, and immutable.

Tokenization can apply to a wide array of assets, including:

- Real estate

- Commodities (like gold)

- Artwork and collectibles

- Corporate equity

- Funds and securities

- Carbon credits

- Intellectual property

The broader objective of tokenization is to increase liquidity, reduce operational friction, and enable fractional ownership of traditionally illiquid assets.

Related Read: What is Tokenization

Tokenization of Private Equity: Explained

Tokenization of private equity is the process of converting ownership interests in privately held companies into digital tokens recorded on a blockchain. These tokens serve as cryptographic representations of equity, meaning that instead of holding traditional paper shares or illiquid contracts, investors hold secure digital tokens that are faster to transfer, easier to manage, and more transparent.

Unlike traditional private equity investments, which often involve cumbersome legal documentation, long lock-in periods, and complex investor agreements, private equity tokenization simplifies the process using smart contracts and blockchain infrastructure. The result is a modern, streamlined approach to managing and exchanging private equity stakes.

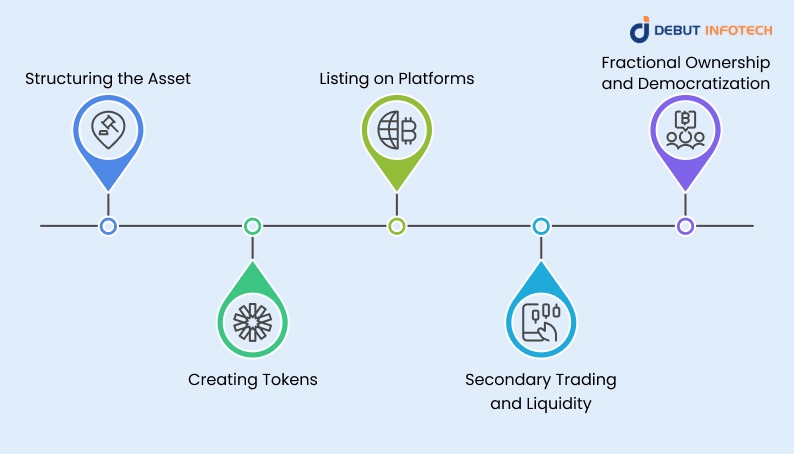

Here’s how the process typically unfolds:

● Structuring the Asset

The process begins with identifying the specific private equity instrument to be tokenized, such as common shares, preferred shares, convertible notes, or limited partnership interests. Legal teams work to map the ownership structure, shareholder rights, and compliance obligations, including jurisdiction-specific rules like KYC (Know Your Customer) and AML (Anti-Money Laundering).

Proper structuring ensures that the token accurately reflects the investor’s legal entitlements. This step often includes setting up a Special Purpose Vehicle (SPV) or trust to separate the tokenized asset and facilitate ownership tracking.

● Creating Tokens

Once the legal structure is established, token development starts, wherein blockchain smart contracts create digital tokens. These tokens are coded for ownership rights and may have varying logic for voting power, profit sharing, transfer restrictions, or vesting schedules.

In order to ensure interoperability and compliance, these often use a common set of standards like ERC-20 (fungible tokens) or ERC-1400 (security tokens with compliance layers). Once developed, investors or custodians keep these tokens secure in digital wallets.

● Listing on Platforms

These newly minted equity tokens are issued and listed on specialized tokenization platforms and digital marketplaces that link issuers and investors. These platforms are blockchain-enabled investment portals with features to onboard investors, check compliance automatically, sign documents, and integrate payments.

After successfully listing tokens on these platforms, issuers can raise capital from a global set of investors, appealing to both institutional and retail demand. This effectively broadens access, which is often constricted in traditional symbol fundraising to accredited investors only, or keeps the windows strictly closed.

● Secondary Trading and Liquidity

Perhaps the most revolutionary feature of tokenized private equity is the ability to trade tokens on secondary markets. Traditionally, private equity investments are highly illiquid—investors are often locked in for 7–10 years before realizing returns. Tokenization changes that.

Once the primary issuance is complete, equity tokens can be listed on compliant exchanges or peer-to-peer marketplaces that support security token trading. This enables faster exits, price discovery, and liquidity features rarely available in traditional private equity environments.

● Fractional Ownership and Democratization

A single equity stake in a private company can be divided into thousands of tokens through tokenization. This fractional ownership model allows investors to buy smaller portions of a company, reducing the barrier to entry and enabling participation from a broader audience.

For example, a $10 million stake in a startup could be divided into 10,000 tokens, each worth $1,000. An investor could now participate in a premium private equity round without needing millions of dollars upfront. This democratization opens the door to more inclusive investment ecosystems and diversifies funding sources for issuers.

Related Read: Securing Data with Tokenization

Benefits of Tokenized Private Equity

The tokenization of private equity introduces a range of advantages that address the traditional limitations of this asset class:

1. Increased Liquidity

Private equity investments are typically illiquid and require long holding periods. Tokenized private equity enables secondary trading, allowing investors to exit early or diversify their portfolios more freely.

2. Fractional Ownership

Tokenization allows for smaller investment sizes, opening the door for a broader pool of investors. This makes equity tokenization particularly attractive to startups and mid-sized companies looking to raise funds from a global audience.

3. Transparency and Security

All token transactions are recorded on the blockchain, creating an immutable audit trail. Smart contracts enforce compliance, reduce human error, and enhance trust between parties.

4. Operational Efficiency

Tokenization eliminates intermediaries, reduces paperwork, and automates processes like dividend distribution, KYC/AML checks, and investor onboarding.

5. Global Accessibility

Using digital tokens and decentralized platforms, investors can participate in private equity markets from anywhere in the world, no longer restricted by geography or gatekeepers.

Related Read: From Physical to Digital: Tokenization

Key Use Cases for Private Equity Tokenization

- Venture Capital Funds: Tokenization makes it easier for VC firms to raise capital by offering tokenized fund shares, improving access for smaller or international investors.

- Family Offices and Institutional Investors: Large investors benefit from faster settlement, better portfolio management, and easier asset transfers through digital tokens.

- Startups and Growing Enterprises: Companies can raise funds faster and with fewer intermediaries by issuing tokenized equity directly to the market via tokenization companies.

- Mergers and Acquisitions: Tokenization simplifies equity swaps and stakeholder payouts during buyouts or restructuring.

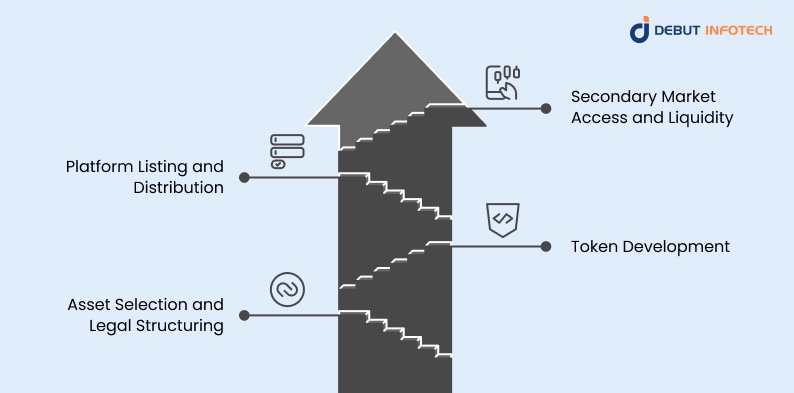

How the Tokenization Process Works

Tokenizing private equity involves several carefully coordinated steps that bring together legal, technological, and operational elements. Each phase plays a critical role in transforming traditional equity into a compliant and tradeable digital asset. Below is a deeper dive into the process:

Step 1: Asset Selection and Legal Structuring

The tokenization journey begins with identifying which asset will be tokenized. In the context of private equity, this could be common or preferred shares, convertible notes, partnership interests, or fund units. Once selected, legal experts analyze the asset class, the investor base, and the jurisdiction to determine the most appropriate legal framework.

This step is essential for ensuring regulatory compliance. For example, if the tokenized asset qualifies as a security, it must comply with securities regulations like Know Your Customer (KYC), Anti-Money Laundering (AML), and investor accreditation requirements. Legal advisors may also assist in setting up Special Purpose Vehicles (SPVs) or trusts to simplify ownership rights and ensure seamless integration with blockchain-based issuance.

Step 2: Token Development

Once the asset is legally structured, the next phase is technical: the creation of the actual digital tokens. This is where token development comes in. A real estate tokenization company like Debut Infotech designs and deploys smart contracts that define the rules for token issuance, transfer, compliance, dividend payouts, voting rights, and more.

During this process, data tokenization techniques may be used to secure sensitive information such as investor credentials, cap tables, and financial documents, ensuring that the platform meets enterprise-grade security and privacy standards.

Developers also select a token standard appropriate to the use case. Popular standards include:

- ERC-20 for fungible tokens

- ERC-721 for non-fungible assets

- ERC-1400 for security tokens with compliance layers

These tokens are then minted on a chosen blockchain—usually Ethereum or a permissioned network, depending on the project’s requirements.

Step 3: Platform Listing and Distribution

After token creation, the digital securities are integrated into a tokenization platform for offering, distribution, and investor onboarding. These platforms act like a blockchain-based version of a stock exchange or crowdfunding portal, allowing issuers to manage token sales, regulatory compliance, and document signing in one environment.

Investors go through a digital onboarding process involving KYC/AML checks, wallet creation, and investment agreement signing—all enabled through smart contracts and automation. Once verified, investors can purchase tokenized private equity shares using fiat currency, stablecoins, or cryptocurrencies, depending on the platform’s integration.

This step enables broader participation, especially for global or retail investors who previously lacked access to such investment opportunities.

Step 4: Secondary Market Access and Liquidity

Perhaps one of the most game-changing aspects of tokenization in private equity is the ability to unlock secondary market liquidity. After the primary issuance, tokens can be listed for trading on decentralized or regulated secondary exchanges that support security tokens.

These marketplaces allow investors to buy and sell equity tokens peer-to-peer, creating opportunities for price discovery, quicker exits, and portfolio rebalancing. For example, instead of waiting 7–10 years for a private equity fund to liquidate, an investor can now sell their stake as soon as there is demand.

Market mechanisms such as automated market makers (AMMs), order books, or liquidity pools can be integrated to enhance trading efficiency. This development marks a significant shift from traditional private equity markets, which are often opaque and difficult to navigate for smaller investors.

Types of Tokenized Assets in Equity Markets

Tokenization isn’t limited to just private equity. Various forms of equity and financial instruments can be tokenized:

- Common and Preferred Shares

- Convertible Notes

- SAFE Agreements

- Equity Options and Warrants

- Fund Tokenization (e.g., ETFs, REITs)

The growing list of equity tokens includes both startup equities and shares in venture capital or private equity funds. This trend is supported by increased adoption of Tokenization platforms and blockchain protocols.

Tokenization Beyond Equity

To appreciate the scope of this innovation, it’s helpful to understand how tokenization extends into other sectors:

- Real Estate Tokenization Platforms: Allow fractional ownership in property assets, enabling global investment in commercial and residential projects.

- Gold Tokenization: Converts physical gold into tradeable digital tokens backed by vault reserves.

- Credit Carbon Tokenization: Enables trading of verified carbon offsets on blockchain networks.

- Payment Tokenization: Protects financial transactions by replacing sensitive payment data with secure, tokenized alternatives.

- AI Tokenization and NLP Tokenization: Represent IP or algorithmic models as blockchain assets.

- Real World Asset Tokenization: Applies tokenization to infrastructure, commodities, and energy projects.

Each of these use cases reflects how token development is expanding the boundaries of asset ownership and access.

Related Read: Legal Aspects of Asset Tokenization

Challenges in Private Equity Tokenization

Despite the benefits, several hurdles still exist:

1. Regulatory Uncertainty: Tokenized securities must comply with existing laws, such as KYC/AML, investor qualification rules, and securities registration, which vary widely across jurisdictions and remain in flux.

2. Technology Integration: Not all legacy systems can seamlessly integrate blockchain. Firms may require complete digital transformation or rely on intermediaries for compliance and custody.

3. Market Education: Investors and issuers still require significant education about how tokenized equity works, what risks are involved, and how secondary trading functions.

4. Platform Fragmentation: With dozens of emerging tokenization platforms, liquidity and interoperability between platforms are still developing, leading to siloed markets.

The Future of Private Equity Tokenization

The tokenization of private equity is still in its early stages, but momentum is building fast. Regulatory clarity, improved token standards, and better platform integration will accelerate adoption.

Large financial institutions and real estate tokenization companies are already exploring partnerships with blockchain firms to bring tokenized assets to mainstream portfolios. As tokenization companies mature, they are expected to offer more robust services—from compliance automation and identity verification to full-scale token development and asset servicing.

In the coming years, we can expect:

- Integration of AI and AI tokenization to manage investor onboarding and portfolio analytics

- Widespread use of fund tokenization for PE and VC funds

- Regulatory sandboxes to support innovative models of equity tokenization

- Deeper liquidity across jurisdictions through cross-platform cooperation

Build Your Own Tokenization Platform with Debut Infotech

Whether you need equity tokenization, fund tokenization, or multi-asset support, our expert blockchain developers will help you create a robust, scalable tokenization solution that empowers growth and compliance.

Conclusion

The convergence of private equity and blockchain sets the stage for a new era in investment and capital markets. Through private equity tokenization, investors gain greater access, flexibility, and transparency, while issuers benefit from streamlined fundraising and improved liquidity.

However, the path to widespread adoption requires thoughtful execution. Regulatory compliance, secure token development, and investor education are vital pillars for success. As more firms explore tokenization of private equity, the market will shift toward greater inclusivity, efficiency, and global access to private capital.

With the right technology partner—like Debut Infotech—businesses can confidently embrace the future of tokenized finance and lead in the next wave of decentralized investment innovation.

Frequently Asked Questions

Q. What is private equity tokenization?

A. Private equity tokenization is the process of converting ownership rights in a private company into blockchain-based digital tokens. These tokens represent equity shares and can be traded or transferred more easily, enhancing liquidity and broadening investor access to traditionally illiquid assets.

Q. How does the tokenization of private equity work?

A. The tokenization process involves structuring the equity legally, developing smart contracts, issuing tokens on a blockchain, and listing them on tokenization platforms. Investors then purchase and trade these tokens, which represent fractional ownership in a private company or fund.

Q. What are the benefits of tokenized private equity?

A. Tokenized private equity offers several advantages, including fractional ownership, improved liquidity through secondary trading, faster settlements, broader investor reach, enhanced transparency via blockchain records, and lower administrative costs due to smart contract automation.

Q. Are there legal requirements for equity tokenization?

A. Yes. The tokenization of securities, including private equity, must comply with existing financial regulations such as KYC (Know Your Customer), AML (Anti-Money Laundering), and securities registration laws. Legal compliance varies across jurisdictions and is a critical part of token development.

Q. What’s the difference between equity tokenization and fund tokenization?

A. Equity tokenization involves converting shares of private companies into digital tokens, while fund tokenization refers to creating tokens that represent ownership in investment funds such as venture capital or private equity funds. Both increase accessibility and liquidity but apply to different financial structures.

Q. What types of assets can be tokenized beyond equity?

A. Beyond equity, tokenization can be applied to a variety of real-world and financial assets, including real estate, gold, carbon credits, intellectual property, and even AI or NLP models. This broader application is referred to as real world asset tokenization.

Q. How can Debut Infotech assist with private equity tokenization?

A. Debut Infotech provides end-to-end tokenization solutions including legal structuring support, smart contract development, platform integration, and investor onboarding. Whether you need equity tokenization, fund tokenization, or real estate tokenization platforms, our team ensures compliance, security, and scalability.

Talk With Our Expert

Our Latest Insights

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment