Table of Contents

Home / Blog /

DeFi Yield Farming Explained: A Beginner’s Guide to Passive Income

October 31, 2025

October 31, 2025

The emergence of DeFi yield farming has changed the nature of interaction between investors and cryptocurrencies. Yield farming, initially viewed as a niche idea, is now one of the most popular ways to generate passive revenue in decentralized finance (DeFi). Investors can achieve high returns by providing liquidity to decentralized platforms that utilize blockchain technology and smart contracts, thereby bypassing traditional financial institutions.

Simply stated, yield farming enables users to earn rewards, often in the form of governance tokens or interest rates, by depositing their cryptocurrencies into liquidity pools. This decentralized model eliminates intermediaries, increases transparency, and provides users with new ways to leverage their crypto holdings to their advantage. Nevertheless, to succeed, it is crucial to understand how yield farming works, the associated risks, and how to select the most suitable DeFi platforms. This comprehensive overview will cover all the key information about yield farming in DeFi, including its principles, advantages, tools, potential risks, and how a major blockchain development company like Debut Infotech can assist.

Ready to Build Your Own DeFi Yield Farming Platform?

Partner with Debut Infotech — a leading DeFi development company — to create secure, scalable, and high-performing yield farming solutions that drive real results.

Understanding DeFi and Yield Farming

It is essential to understand DeFi before exploring the yield farming mechanism. DeFi is a blockchain-based platform that enables users to participate in conventional financial transactions, such as borrowing, lending, and trading, without the need for intermediaries or banks. Rather, decentralized applications (dApps) and smart contracts run transactions automatically on networks based on blockchains, including Ethereum, BNB Chain, or Polygon.

Yield farming in DeFi refers to the process of staking or lending crypto assets in return for interest or additional tokens. These incentives, often referred to as yield farming rewards, are paid to users for providing liquidity to decentralized exchanges or lending platforms. Unlike traditional savings accounts that offer minimal returns, crypto DeFi yield farming can generate significantly higher yields, though with higher risks.

How Does DeFi Yield Farming Work?

In simple terms, yield farming works by allowing users to deposit their cryptocurrencies into a liquidity pool. This pool is a smart contract that holds funds used for decentralized trading, lending, or borrowing. When users deposit assets, they receive liquidity provider (LP) tokens representing their share of the pool.

The yield farming rewards come from various sources, including transaction fees, lending interest, and newly minted governance tokens. The higher the liquidity and the longer the deposit, the greater the potential yield. However, factors such as impermanent loss and market volatility can affect returns.

For example, if you deposit ETH and USDT into a decentralized exchange’s liquidity pool, you earn fees from trades that occur between those tokens. Some platforms also offer extra rewards in the form of their native tokens.

Types of DeFi Wallets for Yield Farming

To start yield farming, you need a DeFi wallet- a digital wallet that connects directly to decentralized applications. These wallets enable users to store tokens, interact with smart contracts, and track farming rewards. The most popular wallet types include:

1. Non-Custodial Wallets: These wallets give you complete control over your private keys and assets. Examples include MetaMask and Trust Wallet. They are ideal for those who value privacy and control, but require users to take responsibility for their own security.

2. Hardware Wallets: For long-term yield farmers, hardware wallets like Ledger and Trezor offer enhanced protection against hacks by storing assets offline. They can still connect to dApps through wallet interfaces.

3. Mobile and Web Wallets: These are user-friendly and convenient, suitable for beginners in DeFi and yield farming. However, they may be less secure than hardware options.

Choosing the right DeFi wallet development solution is crucial. Many DeFi companies and blockchain consultants now offer secure, user-friendly wallet designs that integrate directly with leading DeFi lending platforms and aggregators.

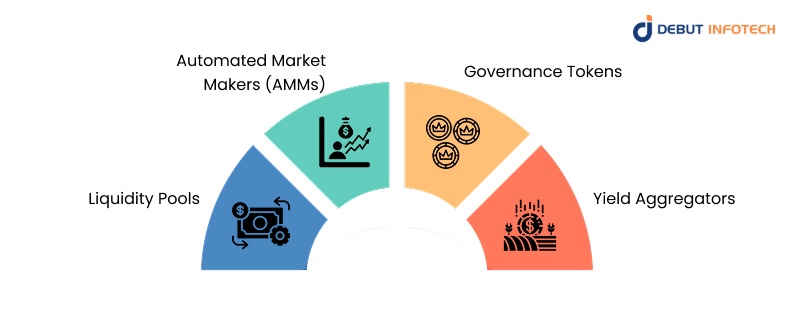

Key Components of DeFi Yield Farming

To truly grasp how to yield farm DeFi, it’s essential to understand the fundamental components that power this innovative financial system. Each element plays a crucial role in ensuring liquidity, governance, and the distribution of rewards across decentralized finance protocols.

1. Liquidity Pools

Liquidity pools are the backbone of every DeFi yield farming ecosystem. They consist of smart contracts that hold funds deposited by users to facilitate decentralized trading, lending, or borrowing. Instead of relying on intermediaries, liquidity pools automate transactions between buyers and sellers, ensuring constant market activity. In return, liquidity providers earn a share of the transaction fees and yield farming rewards, creating an incentive-driven ecosystem. These pools also serve as the foundation for DeFi staking platforms, allowing participants to earn passive income while supporting decentralized exchanges.

2. Automated Market Makers (AMMs)

Automated Market Makers (AMMs) are the engines that drive decentralized exchanges (DEXs). Unlike traditional order books, AMMs utilize mathematical algorithms, such as the constant product formula, to determine asset prices based on the balance of supply and demand within the liquidity pool. This innovation enables continuous and permissionless trading across various tokens. By contributing liquidity to AMM-based platforms like Uniswap or PancakeSwap, users can participate in DeFi farming and earn proportional fees from each trade.

3. Governance Tokens

In the world of DeFi and yield farming, governance tokens serve a dual role, rewarding users and empowering them with decision-making rights. Platforms often distribute governance tokens, such as COMP, AAVE, or CRV, to liquidity providers as part of their incentive models. Holders of these tokens can vote on protocol upgrades, fee adjustments, or new feature proposals. This decentralized governance structure fosters transparency and community ownership, reinforcing the idea that DeFi platforms are built for and by their users.

4. Yield Aggregators

Yield aggregators are powerful tools that simplify the process of earning from DeFi yields. Platforms such as Yearn.Finance or Beefy Finance acts as a DeFi aggregator, automatically scanning multiple liquidity pools and protocols to find the highest-yield opportunities for users. By reallocating assets across platforms, they help investors maximize returns with minimal manual intervention. This automation streamlines the management of multiple wallets and pools, minimizing gas fees through smart contract optimization.

The Benefits of DeFi Yield Farming

Yield farming offers several advantages that make it attractive to crypto investors:

1. Passive Income Generation: The most apparent benefit is the ability to earn passive income from idle crypto assets. By locking funds in DeFi protocols, users can earn regular interest or token rewards.

2. High-Yield Opportunities: Compared to traditional financial products, DeFi yields can be highly competitive. Early participants in new platforms often receive higher incentives.

3. Transparency and Security: All transactions in yield farming occur through smart contracts on public blockchains, offering unmatched transparency and auditability.

4. Accessibility and Control: Anyone with an internet connection and a crypto wallet can participate, without permission or intermediaries.

5. Ecosystem Growth: Yield farming encourages liquidity, supporting the growth of DeFi lending platforms, exchanges, and decentralized apps (dApps) across the blockchain ecosystem.

Types of Yield Farming Strategies

1. Liquidity Mining: In this method, users deposit funds into a decentralized exchange and earn yield farming rewards in return. Liquidity mining remains one of the most common and profitable yield farming strategies.

2. Lending and Borrowing: Platforms like Aave or Compound allow users to lend assets and earn interest while borrowers use crypto as collateral.

3. Staking: Users lock tokens into a network to support operations and earn staking rewards. This approach is often less risky but yields lower returns compared to liquidity farming.

4. Aggregator Farming: Here, yield aggregator tools automatically move funds between different protocols to optimize returns.

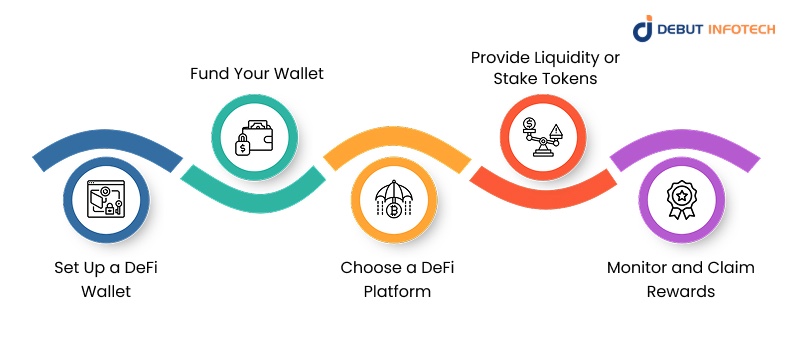

How to Start Yield Farming in DeFi

For beginners, entering the world of DeFi and yield farming can feel complex at first. However, with the right approach and understanding of the tools involved, you can easily start earning passive income through decentralized platforms. Here’s a detailed breakdown of how to get started and what each step involves.

1. Set Up a DeFi Wallet

The first step in yield farming is to create a secure crypto DeFi wallet. Popular non-custodial wallets such as MetaMask, Trust Wallet, or Coinbase Wallet give you complete control over your private keys and digital assets. These wallets connect directly to decentralized apps (dApps), allowing seamless interaction with liquidity pools and staking platforms.

When choosing a wallet, look for one that supports multi-chain access, built-in swaps, and integration with DeFi aggregators. Security is essential, so always enable two-factor authentication and store recovery phrases offline. Working with a trusted DeFi wallet development company ensures that you use a product with robust smart contract architecture and strong protection against phishing or fraud.

2. Fund Your Wallet

Once your wallet is ready, the next step is to deposit crypto assets. You’ll need tokens such as ETH, BNB, MATIC, or stablecoins like USDT and USDC, which are commonly used in liquidity pools. Most yield farming platforms require a pair of tokens, such as ETH/USDC, to add liquidity and start earning fees or interest.

Ensure you have enough tokens to cover both your investment and network gas fees. Depending on the blockchain network (Ethereum, BNB Chain, or Polygon), gas fees may vary. A small initial investment is a great way to learn the ropes before expanding your yield farming portfolio.

3. Choose a DeFi Platform

The next step is to choose where to farm. The best DeFi platforms for yield farming differ in terms of risk, reward potential, and supported assets. Popular platforms, such as Uniswap, PancakeSwap, and Aave, offer a range of options, including liquidity provision, lending, and staking.

When selecting a platform, evaluate factors like total value locked (TVL), community reputation, and the transparency of their smart contracts. Avoid projects that seem too new or promise unrealistically high yields; these may be DeFi wallet scams or unreliable ventures.

4. Provide Liquidity or Stake Tokens

After selecting your preferred DeFi investment platform, you can start earning by either providing liquidity or staking tokens.

- Providing Liquidity: You deposit an equal value of two tokens into a liquidity pool. For instance, depositing ETH and USDC into a trading pair pool enables others to trade those assets, and you earn transaction fees in return.

- Staking Tokens: Some DeFi lending platforms and staking programs allow users to lock up single tokens in smart contracts to earn rewards over time. This is ideal for users who prefer steady yields without the risk of impermanent loss.

Both approaches rely on smart contracts to automate the distribution of rewards and maintain transparency. Platforms that utilize well-designed DeFi token development frameworks and audited code offer enhanced security for participants.

5. Monitor and Claim Rewards

Once your funds are active in a yield farm or staking pool, it’s essential to track your earnings and portfolio performance. Use built-in dashboards or external DeFi tracker tools to view your yield farming rewards, liquidity value, and market fluctuations.

Working with a reliable DeFi development company or blockchain consultants can also help new users design strategies and ensure secure participation.

The Role of DeFi Platforms and Aggregators

A DeFi investment platform is where all yield farming activities happen. These platforms enable users to stake, lend, borrow, and trade assets in a decentralized environment. Some leading DeFi companies focus on creating solutions that enhance yield optimization and risk management.

On the other hand, DeFi aggregators simplify the process by scanning multiple platforms and directing funds to the most profitable pools. They act as automated yield managers, ideal for users who prefer a hands-off approach to earning.

The Technology Behind DeFi Yield Farming

The power of yield farming lies in enterprise blockchain development and smart contract automation. Every transaction, reward calculation, and yield distribution happens without human intervention, reducing errors and enhancing trust.

Top-tier blockchain development companies, such as Debut Infotech, design and deploy secure smart contracts, build custom DeFi lending platforms, and develop comprehensive DeFi token development solutions. They ensure that these protocols are transparent, efficient, and interoperable across blockchains.

Moreover, DeFi wallet development and DeFi yield farming development rely heavily on robust blockchain architecture to handle large transaction volumes while maintaining security.

Common Risks in Yield Farming

While DeFi farming can be profitable, it also comes with risks.

1. Smart Contract Vulnerabilities: Even the best-coded contracts can have bugs or exploits. A single vulnerability can result in the loss of funds.

2. Impermanent Loss: This occurs when the value of deposited tokens changes relative to each other, reducing the total return.

3. Platform Risks: Not all DeFi companies are trustworthy. Some new projects may have poor tokenomics or limited security audits.

4. Market Volatility: Since crypto prices fluctuate rapidly, yield farming returns can vary drastically.

5. Scams and Rug Pulls: Unscrupulous developers sometimes abandon projects after collecting users’ funds. Always research platforms carefully.

How Blockchain Consultants Help Navigate DeFi

Navigating the world of DeFi and yield farming can be complex. That’s where blockchain consultants play a crucial role. They help investors understand market trends, assess risks, and select the right DeFi investment platforms.

Firms like Debut Infotech offer DeFi development services, from designing DeFi lending platforms to developing DeFi tokens and yield farming protocols that are transparent, scalable, and secure. Their expertise ensures businesses and individuals can maximize yields while maintaining safety.

Future of DeFi Yield Farming

As DeFi continues to mature, yield farming will evolve to offer more sustainable and user-friendly models. With enhanced security, cross-chain interoperability, and advanced enterprise blockchain development, the next generation of DeFi platforms will offer a smoother user experience.

We can also expect DeFi wallet development and aggregator technologies to become more advanced, integrating AI-driven yield optimization tools. This progress will enable both retail investors and institutions to participate in decentralized finance with greater confidence.

Why Work with Debut Infotech

Debut Infotech is a leading DeFi development company specializing in building secure, scalable, and innovative blockchain solutions. From DeFi lending platform development and DeFi token development to DeFi wallet and yield farming solutions, Debut Infotech empowers businesses to create and manage next-generation financial ecosystems.

By combining advanced blockchain architecture, expert consulting, and transparent practices, Debut Infotech enables enterprises and startups to confidently enter the DeFi space. Their team of blockchain consultants ensures that every project, from dApp creation to DeFi yield farming development, meets global standards of performance and compliance.

Empower Your Business with Next-Gen DeFi Solutions

From yield farming development to DeFi lending platforms, Debut Infotech helps you harness blockchain innovation for sustainable growth.

Conclusion

DeFi yield farming represents a revolutionary shift in how we earn passive income through cryptocurrencies. It democratizes finance, offering opportunities to anyone willing to learn and participate. While it comes with risks, understanding the mechanics, using reliable platforms, and applying sound strategies can make it a rewarding venture.

As the DeFi landscape continues to evolve, businesses and investors seeking to build, integrate, or profit from decentralized finance can rely on experts like Debut Infotech. Their DeFi development services and tailored blockchain solutions ensure that every step, whether in DeFi farming, lending, or token creation, delivers security, scalability, and long-term value.

Frequently Asked Questions

A. DeFi yield farming is a process where users earn rewards by staking or lending their crypto assets on decentralized platforms to provide liquidity.

A. To start, create a DeFi wallet, fund it with crypto, choose a trusted platform, and deposit tokens into liquidity pools or staking programs.

A. Rewards come in the form of interest, trading fees, or new tokens distributed by the platform for providing liquidity.

A. While it can be profitable, yield farming carries risks, including smart contract bugs, market volatility, and impermanent loss. Always research before investing.

A. Top DeFi platforms for yield farming include Aave, Uniswap, Curve Finance, and Compound, known for security and reliability.

A. A non-custodial DeFi wallet, such as MetaMask or Trust Wallet, allows you to connect directly to decentralized applications (dApps) and manage your assets securely.

A. Blockchain consultants assist with risk assessment, platform selection, and the development of secure DeFi solutions, including lending platforms and yield farming protocols.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment